Exchanged Traded Funds (ETFs)

What is an ETF?

An ETF is an open-ended investment fund similar to a managed fund that is traded on the Australian Stock Exchange (ASX). Their aim is to track the performance of a given index or asset class (like the ASX top 200 companies) and provide the returns of that index or asset class less any fees of the product.

Advantages of ETFs

- Simplicity – ETF’s help investors gain exposure to a range of investment strategies, geographic regions and asset classes through a simple purchase of a share.

- Liquidity – ETF’s are traded on the ASX and can be bought or sold during any trading day.

- Transparency – information relating to ETF’s including underlying portfolio holdings (normally the top 10 holdings) and fees can be accessed at any time through the fund managers website.

- Cost-effective – Because ETFs aim is to simply track the performance of an index or asset class there are no in-built active management fees like most managed funds.

- SMSF friendly – just like shares, ETF’s are eligible to be bought inside Self-Managed Super Funds and have been increasing in popularity in these accounts.

ETFs in the current environment

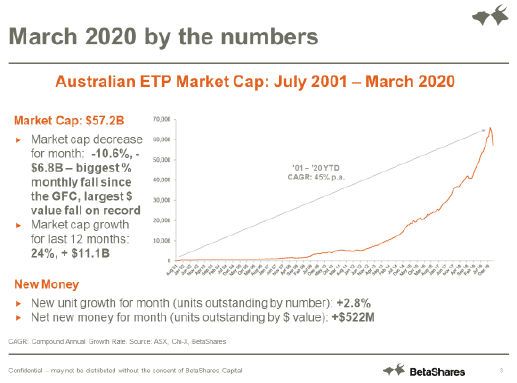

Like all markets across the globe, the ETF market experienced unprecedented flows since the COVID-19 pandemic. The Australian ETF market experienced exponential growth in trading with record flows into the market. However, the value of underlying securities did fall significantly. As seen in the diagram below the ETP (Exchange Traded Product which includes ETFs, managed funds and structured products) Market Cap has grown exponentially between July 2001 – March 2020.

Source: BetaShares

What impacts liquidity?

Liquidity refers to the ability to trade or buy and sell. ETFs are considered as a highly liquid investment as they can easily be bought and sold. However, liquidity or lack thereof in relation to fixed income such as government bonds during the early days of the crisis had an impact on this segment of the ETF market. It is critical to remember that ETF liquidity reflects the liquidity of the underlying market, particularly in volatile markets. One of the important attributes of ETFs is that they tend to track net asset value very closely.

Net asset value

Net asset value (NAV) reflects the market value of the underlying securities in the portfolio adjusted for fees and expenses. NAV is calculated by the value of the sum of all the securities in the portfolio multiplied by the closing market price, divided by the number of units issued by the fund. It is expressed on a per unit basis and is published by the ETF provider or the ASX each day. The market price of an ETF rarely moves out of line from the NAV, because if it does, it provides arbitrage opportunities. During March 2020, due to severe liquidity issues in the underlying government bond market, the NAV of fixed income ETF’s was impacted. This was short lived as liquidity quickly returned to the market.

Conclusion

The discussion above explored ETF’s and their performance in the current market environment. From the COVID-19 pandemic, we saw record trading volume of ETF’s in Australia as they appeared to be the ‘go to’ product for investors in this time of crisis and uncertainty. As economies around the world, including the Australian economy face recession, it is timely to consider defensive strategies relevant to the change environment and prepare for the recovery phase.