Wealth Management at your fingertips.

“Easy, Effective and Empowering Advice”

Advice you can trust

ESTABLISH

Your Goals

We help you identify and achieve your goals with personalised strategic advice.

PROTECT

Your Assets

You've worked hard to build your wealth, we'll help you craft diversified strategies to protect that wealth.

GROW

Your Wealth

Building wealth takes time and discipline, with our expertise we help you make informed decisions.

We are

self-licenced

We are part of the 1 in 5 financial planning firms that is self-licenced, providing us with greater autonomy and control with the advice we can provide.

You are

in control

We have no lock in contracts! Meaning you remain in control and have the right to cancel your contract at any time.

Transparent

fee structure

We charge flat fees and ensure that you are aware of all fees and costs associated with the services

We do not take

any commissions

We take no commissions on any investment products or insurance. For context, advisers can charge up to 30% on your insurance premiums as commission.

Informed

decision making

We want you to understand each step of the process, we aim to educate you and promote your financial literacy.

The average super balance for a 50 year old Australian is $281,000. See how your super is going today!

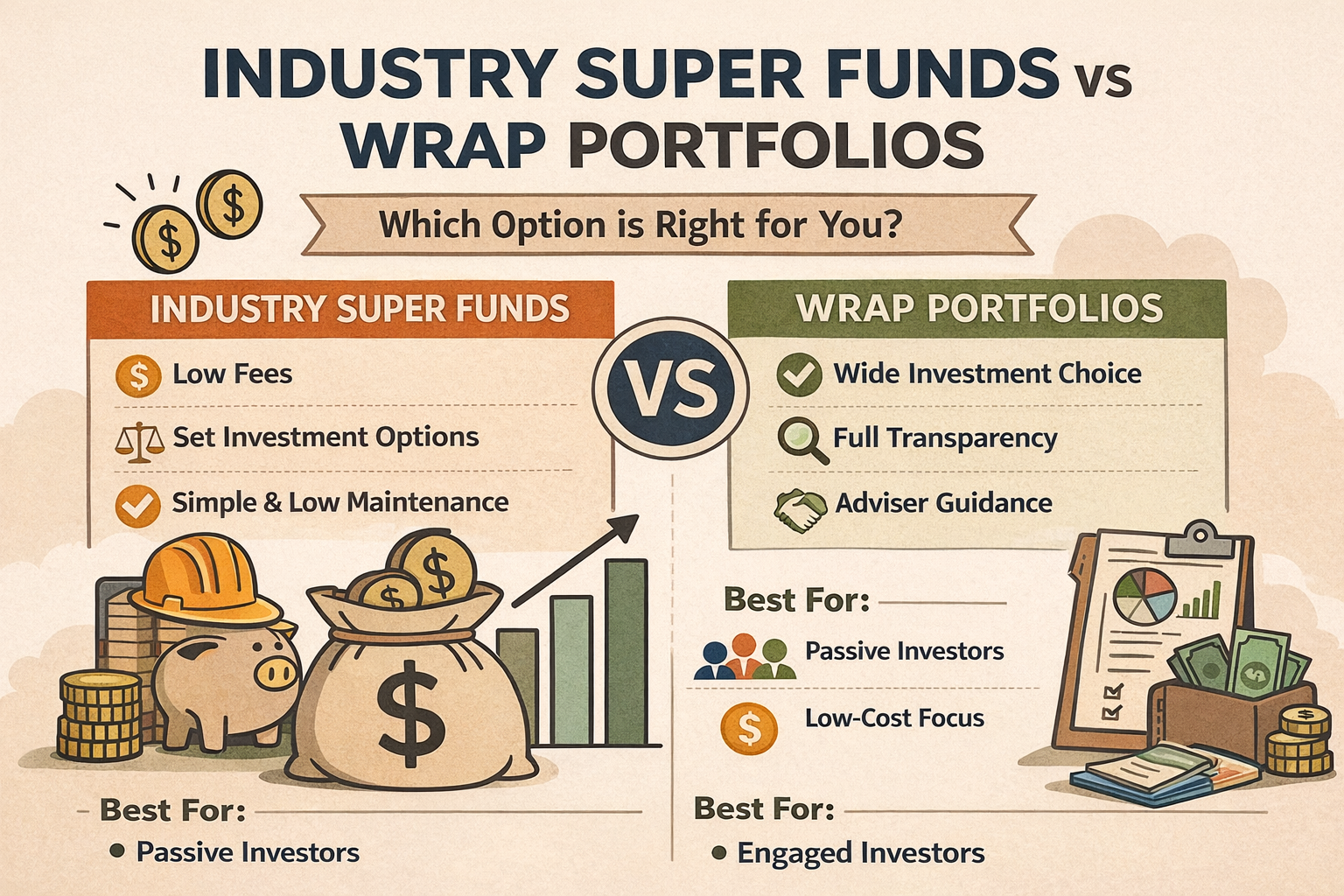

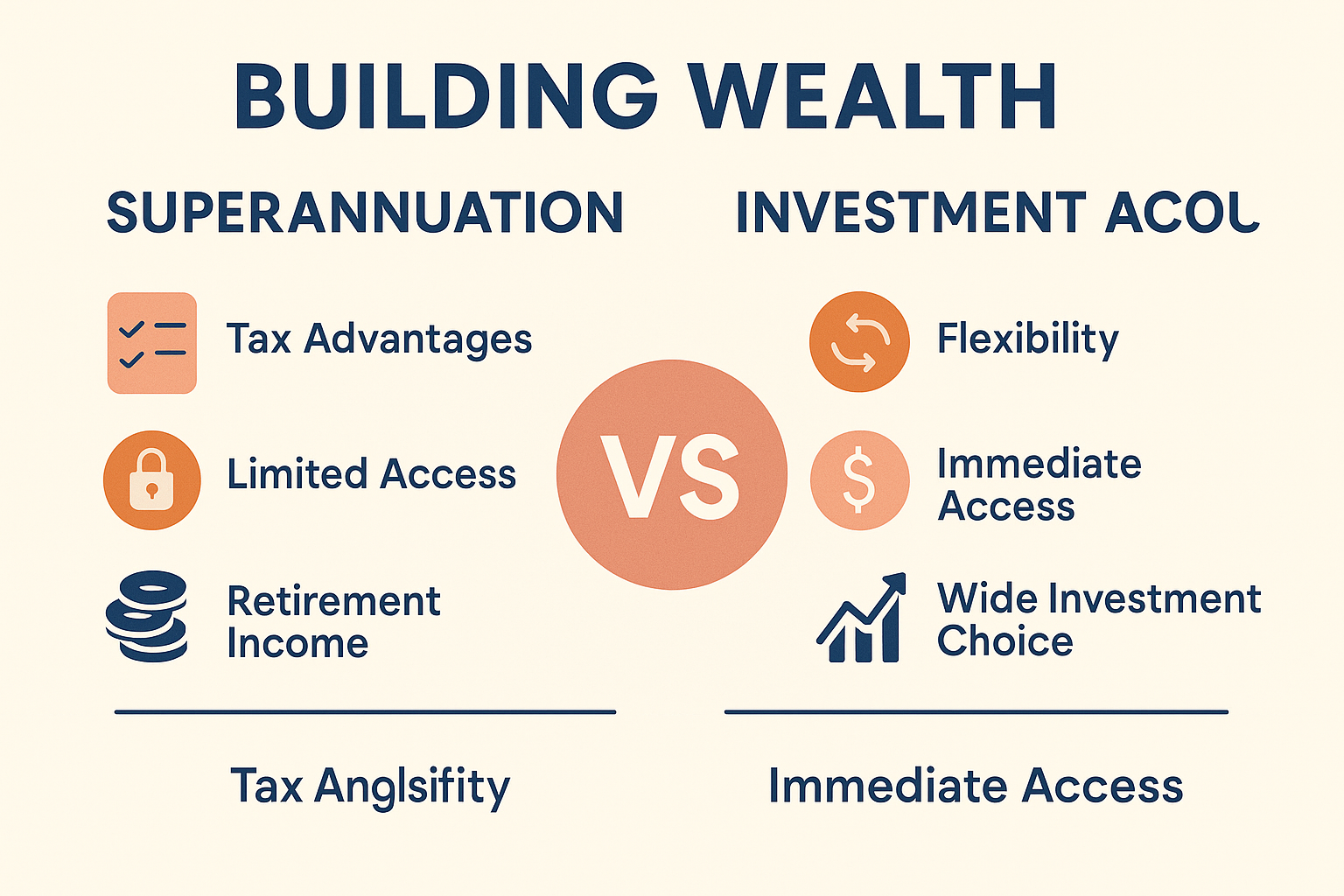

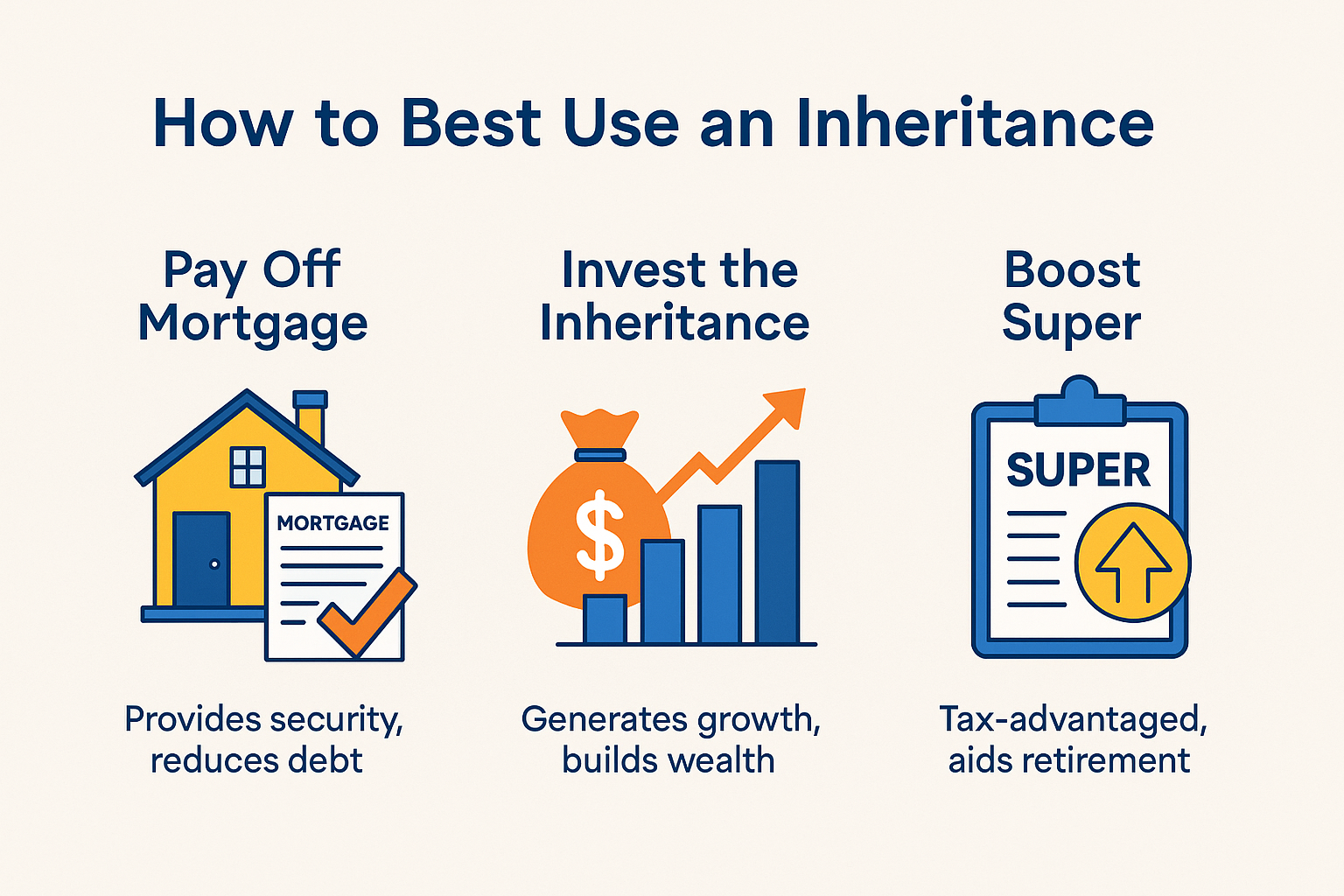

RESOURCES

Knowledge is power. Take action now.

Knowledge is power because it allows individuals to understand complex financial concepts, make informed decisions, and navigate the intricacies of the financial world effectively. With the right knowledge, individuals can take control of their finances, plan for the future, and work towards achieving their financial goals with confidence.

Want to learn more and stay informed about all things finance? Check out our resource library.

Trusted by a community of families, retirees, high net worth individuals and young investors.

-

Denise 65+ years old

Denise 65+ years old"We have been more than happy with our association with Lachlan over the past 7 years, his advice that we have received on numerous occasions, his ability to be able to put into words that we understand and the reasons for the actions he or we should take. Our portfolio has been managed well, especially over the last 18 months keeping us duly informed and checking on our needs which he does on a regular basis. Lachlan promptly answers calls or emails and makes us feel a very valued client, we can also say his staff are equally attentive and met our request for information the same day."

Read more -

Garry & Jan 65+ years old

Garry & Jan 65+ years old"Mark has been our adviser since he joined EPG Wealth. He has taken us through Transition To Retirement into retirement. We have moved interstate but this has not affected his high level of service and communication. His consistent monitoring of our portfolio and continual communication with us has led to its growth. This has given us a comfortable and secure retirement. Mark provided us and our family, valuable advice and assistance regarding short term investments and financial aged care options for an elderly parent. We have recommended others to Mark and will continue to do so."

Read more -

Martin 56+ years old

Martin 56+ years old"I have always found Mark to be very professional, extremely knowledgeable and empathetic to my needs and what I should do to maintain and grow my wealth moving forward. His methods of explaining developments that may affect my financial situation and keeping those explanations comprehensive but at a level of understanding I can comprehend is why I find him one of the best financial service advisors I have met. "

Read more -

Anne 65+ years old

Anne 65+ years old"Mark has given me advice in relation to inheritance and my superannuation and managing finances during my final working years and into my retirement. Mark has always been someone I felt I could fully trust and his advice is clear, concise and very easy to understand. Mark always consults me in relation to any suggested changes in the structure of my finances and is always available if I need to liaise with him. Mark has been someone I’ve always felt confident in."

Read more -

Renee 35+ years old

Renee 35+ years old"Mark understands our life goals, really takes the time to listen to us and provides our family with financial advice relevant to our overall objective. Mark and our family are always on the same page. You can clearly see the passion he has for his work, when there's passion, you perform well... which means our investments perform well!"

Read more -

Ellen And Peter 65+ years old

Ellen And Peter 65+ years old"Mark has given us advice on superannuation and all aspects of our post retirement planning and management. He has our highest recommendations for his honesty and integrity, the coherence and relevancy of his advice and his availability whenever we have needed to discuss issues with him."

Read more -

Leo 65+ years old

Leo 65+ years old"Lachlan is someone we continue to have confidence in re the managing our investments and money plans in retirement. He is always available and immediate responses are what we have come to enjoy. We have found his advice certainly matched our considered plans moving forward and we are more than confident of this continuing."

Read more -

Phil Under 35 years old

Phil Under 35 years old"I have been a client of Mark for over 5 years, he has always answered the phone when I have called and has delivered great results for my portfolio. Mark has a refreshing approach to investments and is enthusiastic about his job."

Read more -

Judy & Mick 65+ years old

Judy & Mick 65+ years old"Hi Lachlan, just thought I would let you know how much we appreciate all the help we have received from you over the years you have managed our Super funds. You and your team at EPG Wealth are not only knowledgeable in financial matters but dedicated to providing us with top-notch service and support, despite the many unforeseeable worldly challenges that have emerged during this time.

I do appreciate that you are always available to answer our many questions, provide guidance, and negotiate on our behalf.

We are beyond grateful knowing that our savings are safe, and we can’t recommend you highly enough!"

Read more

Frequently asked questions

At EPG Wealth, we are dedicated to helping all types of investors achieve their financial goals. Our services encompass a wide range of areas including investment management, retirement planning, estate planning, risk management, tax planning, and more. We provide personalised strategies tailored to each client’s unique financial situation and objectives. Whether you need help setting up the right foundations or ongoing support, we have something on offer for everyone!

Our pricing structure varies depending on the specific services and level of support required by each client. We believe in transparent and fair pricing, and therefore we charge flat fees tailored to meet your individual needs and financial goals. To learn more about our pricing and to receive a customised quote, please contact us directly.

Being self-licensed means that a financial services firm, such as EPG Wealth, holds its own Australian Financial Services License (AFSL) issued by the Australian Securities and Investments Commission (ASIC). This license grants us the legal authority to provide financial advice and services directly to our clients without being affiliated with a larger financial institution or licensee.

By being self-licensed, EPG Wealth has the flexibility to offer a wider range of financial products and services, tailor advice to meet the specific needs of clients, and maintain greater control over compliance and regulatory matters. This independence allows us to act in the best interests of our clients and provide objective, unbiased advice without any conflicts of interest associated with external affiliations.