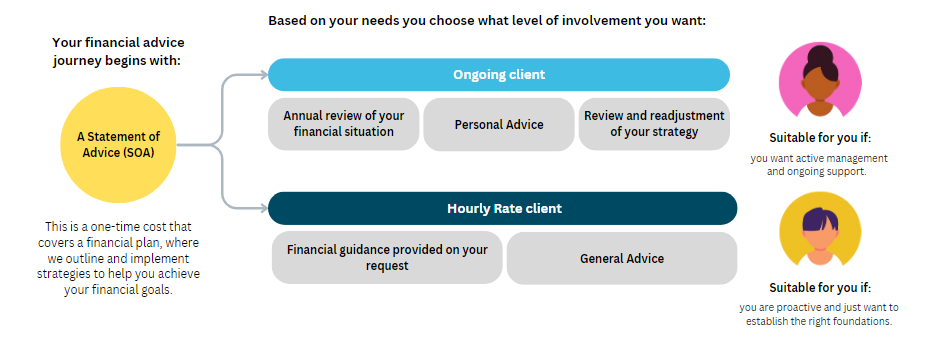

Our Service Packages

We will assist you in finding a package that best meets your financial needs.

Your journey starts with an initial Statement of Advice (SOA) and its implementation, after which you can select the right package. Find out what it would cost you now!

We have a service package for everyone

We charge flat fees with no comissions

We have no lock-in contracts

No matter your financial position, we have a service package for you.

Personal Advice Packages

Our Personal Advice Packages are designed to cater to investors at various stages of their financial journey. Whether you’re a younger investor looking to grow your wealth or a high net-worth individual with complex financial needs, we have a package tailored for you. Our Personal Advice packages offer flexible payment options, allowing a portion of the cost to be covered through your superannuation or pension, making it easier to access tailored advice without straining your immediate cash flow.

Essential

-

Best for individuals or couples comfortable with a passive, long-term investment strategy, preferring lower fees and fewer portfolio adjustments and features.

-

Model Portfolio

-

Up to 2 Account(s) under management

-

Return contact in up to 48 business hours

-

Online or Phone Meetings only

-

1x Asset Allocation per year

-

1x Review Meeting per year

-

1x Post Review Advice included

-

Simple Ad-Hoc Advice included

-

Complex Ad-Hoc Advice (at a charge)

-

Statement of Advice (at a charge)

Comprehensive

-

Ideal for individuals or couples who desire a blend of strategic and tactical allocation. Suitable for those who understand markets and value a proactive approach to managing their wealth.

-

Tailored Portfolio

-

Up to 3 Account(s) under management

-

Return contact in up to 36 business hours

-

Online and Face to Face Meetings

-

3x Asset Allocations per year

-

1x Review Meeting per year

-

1x Post Review Advice included

-

Simple Ad-Hoc Advice included

-

Complex Ad-Hoc Advice included

-

Statement of Advice (discounted)

Private

-

Perfect for high net-worth individuals or couples with a complex financial position needing a bespoke investment plan, and who require a proactive and high touch Investment approach.

-

Premium Tailored Portfolio

-

Unlimited Accounts under management

-

Return contact within 24 business hours

-

Online and Face to Face Meetings

-

6x Asset Allocations per year

-

Up to 2 Review Meeting(s) per year

-

All Post Review Advice included

-

All Ad-Hoc Advice included

-

Offered bespoke investment opportunities

-

Statement of Advice included

The Benefit of Advice

For investors, Vanguard research reported that financial advice improved net returns by

General Advice Packages

Choosing the right financial advice package is essential for establishing a solid financial foundation. Our General Advice Only Packages are designed to meet the diverse needs of investors at various stages of their journey. For young investors aiming to build wealth, these packages provide the guidance needed to get on top of your finances and set the right foundations for financial success. While these packages do not include personal advice, you will receive a Statement of Advice (SOA) at an upfront additional cost which will establish a financial plan that meets your financial goals. Enjoy a hands-off experience with the assurance that our advisers still maintain visibility over your financial situation, assisting you stay on track towards your goals.

hourly rate

-

The Hourly Rate package is best suited to smart, seasoned investors who know what they want, or new investors looking to establish the right financial foundations. You should be proactive and self-educated and manage your investments independently, with access to an adviser as needed to ask questions or assist with anything need.

-

Statement of Advice (at a charge)

-

Charged in 15-minute blocks for Ad-Hoc work

-

Newsletters

-

Return contact from an EPG Wealth Adviser or Support Staff

-

Investment reporting and other information (at request)

-

Access to Client Hub (at a charge)

Jumpstart package

-

The Jumpstart Package provides investors with greater value in terms of financial resources and access to our team. This package is suited to you if you are proactive, disciplined and interested in broadening your financial knowledge or if you need time for your wealth to grow and may need a little bit of help on the journey.

-

Statement of Advice (at a charge)

-

3x 15 minute blocks with an Adviser

-

Newsletters

-

Access to the EPG Wealth team

-

Annual Investment Reporting

-

Access to Premium Educational Resources and Tools

-

Access to Webinars

-

Access to Client Hub

How many times do you get a call from your superfund?

At EPG Wealth we value our clients and actively engage with all our ongoing clients. We believe that advice is more than just managing your investments.

Trusted by a community of families, retirees, high net worth individuals and young investors.

-

Denise 65+ years old

Denise 65+ years old"We have been more than happy with our association with Lachlan over the past 7 years, his advice that we have received on numerous occasions, his ability to be able to put into words that we understand and the reasons for the actions he or we should take. Our portfolio has been managed well, especially over the last 18 months keeping us duly informed and checking on our needs which he does on a regular basis. Lachlan promptly answers calls or emails and makes us feel a very valued client, we can also say his staff are equally attentive and met our request for information the same day."

Read more -

Garry & Jan 65+ years old

Garry & Jan 65+ years old"Mark has been our adviser since he joined EPG Wealth. He has taken us through Transition To Retirement into retirement. We have moved interstate but this has not affected his high level of service and communication. His consistent monitoring of our portfolio and continual communication with us has led to its growth. This has given us a comfortable and secure retirement. Mark provided us and our family, valuable advice and assistance regarding short term investments and financial aged care options for an elderly parent. We have recommended others to Mark and will continue to do so."

Read more -

Martin 56+ years old

Martin 56+ years old"I have always found Mark to be very professional, extremely knowledgeable and empathetic to my needs and what I should do to maintain and grow my wealth moving forward. His methods of explaining developments that may affect my financial situation and keeping those explanations comprehensive but at a level of understanding I can comprehend is why I find him one of the best financial service advisors I have met. "

Read more -

Anne 65+ years old

Anne 65+ years old"Mark has given me advice in relation to inheritance and my superannuation and managing finances during my final working years and into my retirement. Mark has always been someone I felt I could fully trust and his advice is clear, concise and very easy to understand. Mark always consults me in relation to any suggested changes in the structure of my finances and is always available if I need to liaise with him. Mark has been someone I’ve always felt confident in."

Read more -

Renee 35+ years old

Renee 35+ years old"Mark understands our life goals, really takes the time to listen to us and provides our family with financial advice relevant to our overall objective. Mark and our family are always on the same page. You can clearly see the passion he has for his work, when there's passion, you perform well... which means our investments perform well!"

Read more -

Ellen And Peter 65+ years old

Ellen And Peter 65+ years old"Mark has given us advice on superannuation and all aspects of our post retirement planning and management. He has our highest recommendations for his honesty and integrity, the coherence and relevancy of his advice and his availability whenever we have needed to discuss issues with him."

Read more -

Leo 65+ years old

Leo 65+ years old"Lachlan is someone we continue to have confidence in re the managing our investments and money plans in retirement. He is always available and immediate responses are what we have come to enjoy. We have found his advice certainly matched our considered plans moving forward and we are more than confident of this continuing."

Read more -

Phil Under 35 years old

Phil Under 35 years old"I have been a client of Mark for over 5 years, he has always answered the phone when I have called and has delivered great results for my portfolio. Mark has a refreshing approach to investments and is enthusiastic about his job."

Read more -

Judy & Mick 65+ years old

Judy & Mick 65+ years old"Hi Lachlan, just thought I would let you know how much we appreciate all the help we have received from you over the years you have managed our Super funds. You and your team at EPG Wealth are not only knowledgeable in financial matters but dedicated to providing us with top-notch service and support, despite the many unforeseeable worldly challenges that have emerged during this time.

I do appreciate that you are always available to answer our many questions, provide guidance, and negotiate on our behalf.

We are beyond grateful knowing that our savings are safe, and we can’t recommend you highly enough!"

Read more

cASE STUDY

How much you can save from removing insurance commissions?

Here at EPG Wealth, our advisers do not believe in charging a commission for insurance related advice. Through doing so, our advisers embody the company’s core values of establishing, protecting, and growing the assets of our clients through providing unbiased and impartial advice.

For all new clients from 1 April 2020, we will not accept any commission from the insurer. If the insurer requires us to take a commission, we will give the full amount back to the client.

For example, consider a couple with the same age and occupation, Client 1 earns $80,000 and Client 2 earns $120,000. Some additional details to consider are expressed below:

| Client 1 | Client 2 | |

| Sex | Male | Female |

| Age | 35 | 35 |

| Salary | $80,000 p.a. | $120,000 p.a. |

| Occupation | Office Worker | Office Worker |

| Life cover (stepped) | $1,000,000 | $1,000,000 |

| TPD cover (stepped) | $1,000,000 | $1,000,000 |

| Income Protection cover (stepped) (90-day wait, benefit period till age 65) | $4,666 per month benefit | $7,000 per month benefit |

To understand the implications of the commissions charged on the total premium amount, we have broken up the fees over the first year to compare the premium amounts, inclusive and exclusive of the commissions.

Client 1 | First Year Premium p.a. (inclusive of commission) | First Year Premium p.a. (exclusive of commission) | ||

Life Cover | $340.68 | $238.48 | ||

TPD Cover | $240.72 | $168.50 | ||

Income Protection | $754.29 | $528.00 | ||

Critical Illness | $152.96 | $107.07 |

| |

Stamp Duty | $45.36 | $31.75 | ||

Total | $1,534.01 | $1,073.80 | ||

Client 2 | First Year Premium p.a. (inclusive of commission) | First Year Premium p.a. (exclusive of commission) |

Life Cover | $263.56 | $184.49 |

TPD Cover | $244.37 | $171.06 |

Income Protection | $1,548.16 | $1,083.71 |

Critical Illness | $205.79 | $144.05 |

Stamp Duty | $87.70 | $61.39 |

Total | $2,349.58 | $1,644.70 |

Over a 10-year period, the couple saves a total of

$23,442.42

Whilst the total amount may not seem significant in the first year, the client’s total savings accumulates over time, with Client 1 saving $9,026.54 accumulated over a 10-year period and Client 2 saving $14,415.88.

Important assumptions to note relating to the following case study include:

• Value of the cover is indexed.

• Premiums are paid yearly.

• Life and TPD insurance are linked.

• Critical Illness is standalone

• Income protection is an indemnity value.

• Occupation class is A.

• Clients are non-smokers and live in NSW.

• Life and TPD premiums are paid via a Wrap superannuation account.

• Critial Illness and Income Protection are paid personally.

Get in touch with one of our Advisers today!

Frequently asked questions

The Comprehensive Package offers a tailored portfolio, periodic portfolio management, and up to three accounts. It includes more frequent advice and meetings, both online and face-to-face, and is ideal for investors with $500,000 to $1,200,000 in investable assets.

A Statement of Advice (SOA) is a detailed document outlining the financial advice provided. In the Basic Package, the SOA is payable separately. The Comprehensive Package offers a reduced SOA cost, while the Private Package includes the SOA.

The Client Hub provides you with access to your financial position, you are able to update your financial position at any time and we can provide financial modelling based of your needs.

Yes, you can switch packages as your financial situation evolves. Our advisers can help you determine the best package based on your current needs and goals.

Ad-hoc advice refers to financial guidance provided on an as-needed basis outside of regular review meetings. It addresses specific questions or unique situations that arise unexpectedly and may require immediate attention. This type of advice can include investment recommendations, tax strategies, or adjustments to your financial plan due to life changes such as marriage, job changes, or market fluctuations. In our Basic and Comprehensive Packages, complex ad-hoc advice may incur additional charges, while in the Private Package, all ad-hoc advice is included at no extra cost.