Investing carries some big decisions and it is important that these judgments are not clouded by your emotions. Whether you have just started your investment journey or are a seasoned investor, the article below will outline some tips to keep in mind to help ensure your emotions do not get in the way of your financial decisions.

Data has suggested that the average investor typically underperforms when compared to the overall performance of the market and other indices. A US company that has been studying investor behaviour has suggested that over the last 20 years ending December 31, 2019, the S&P500 had an average annual return of 6.06%, whereas average equity investors received returns of 4.25% p.a. This gap has further widened since the Covid-19 pandemic began and has doubled since 2020.

One of the driving factors of this disparity is the withdrawing of assets which minimises an investors capacity to be exposed to the market and continue generating maximum returns.

What do emotions have to do with money?

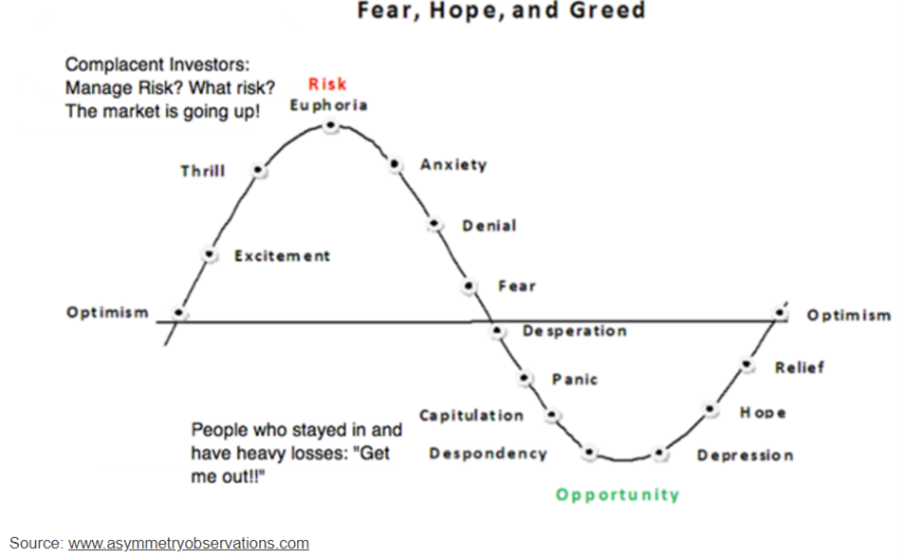

Investing and financial decisions in general for many people can be emotionally charged and often a rollercoaster of different feelings. The cycle of market emotions below suggests that for many investors their emotions work against them. When markets are expected to rise, investors are optimistic, excited and may even increase their exposure to risk as they think making a gain is more certain. However, this is the time that investors should be more considered and cautious in their strategy and not be fueled by feelings of greed.

When markets are plummeting, often investors react by selling their assets and becoming more defensive which is due to the fear and anxiety associated with a fall in the value of their investment. This, however, presents investors with an ideal time to potentially purchase additional holdings and utilise dollar-cost averaging techniques to reduce the overall unit price costs across their portfolio.

Research has found that around 60% of investors reported regretting making impulse or emotionally motivated investment decisions, and therefore it is important to remember the investment fundamentals when making any financial decisions.

Do your research:

The internet has brought with it unlimited access to a variety of resources and information regarding investing. However, many people are still listening to one source and making a decision without cross-checking the validity of that information. This means there is more capacity for mistakes and irrational decisions to be made. It was also that reported around 60% of Generation Z investors engage in making trades when they are intoxicated. Hence, significantly inhibiting their ability to make measured and rational decisions.

A financial adviser is an invaluable resource that acts as a financial psychologist and ensures that you remain disciplined to your investment strategy and do not make emotionally charged decisions. Russell Investments data suggested that those who received financial advice increased their overall returned by 3.75% per annum. Although engaging with an adviser may seem like a big upfront expense, it is likely to cost considerably less than if you allow your emotions to rule your financial decisions and as a result receive unsatisfactory returns or even lose money.

Controlling your emotions:

Everybody is human and therefore it is inevitable that your emotions will change and may cause you to want to make certain decisions. When this occurs, it is important to acknowledge the emotion and how you can respond in a constructive and measured way. Instead of looking at the price of a stock in isolation and then deciding to buy more or sell it, investors can look at indicators of performance including long-term performance reports as well as overall market conditions. Although, past performance is not necessarily indicative of future performance, it may help investors to put things into perspective and make more rational choices over the long-term.

This is also where having a trusted financial adviser can help. Having a reliable resource that you can call during these times can significantly help investors to remain on track to achieve their financial goals and objectives, without sacrificing their mental and emotional health.

Understanding different biases

It is also important to understand the different biases that can cloud an investor’s judgement. Cognitive dissonance refers to when new information conflicts with the information an individual already has. This results in investors focusing on only the good information about a particular stock or share and disregarding the risks or negative aspects associated with it.

Another bias that investors may experience is the illusion of control bias which occurs when individuals avoid making particular decisions as they cannot control the outcome and believe whatever decision they make will be unfavourable. This can cause investors to give up on their strategy or become indifferent to their financial goals and objectives because cannot discern between various courses of action. In this situation, it is important to focus on what investors can control which is remaining invested for the long-term and not trying to time the market.

If any of this sounds like you, you may wish to consult with a financial adviser who can help you to implement long-term strategies to achieve your financial goals and objectives, especially when you feel overcome with emotion. To organise a 20-minute complementary consultation with an EPG Wealth adviser, please click the link.