Superannuation is a crucial component of every working Australian’s life, but it’s frequently clouded by uncertainty and a dash of fear. Understanding how to manage your super investment options and determining how much you need for a comfortable retirement are pivotal steps towards securing your financial future. But fear not! This guide is tailored to shed light on these topics for young professionals, retirement planners, and the broader Australian populace aiming to retire comfortably by age 67.

Why Manage Your Super?

Firstly, your super is your golden ticket to a comfortable retirement. It’s the nest egg you’ll rely on when the time comes to say goodbye to the workforce. And while it may seem like a distant future, the steps you take today can significantly sway the quality of your tomorrow.

The Basics Of Super

Superannuation, or ‘super’, is a compulsory scheme where money is placed in a fund to provide for your retirement. Contributions are made by your employer and, optionally, topped up by you. Over time, this money is invested, so it grows and builds your retirement savings. Sounds straightforward, right? However, the real art comes in managing these investments.

Knowing Your Options

Super funds offer various investment options, including conservative, balanced, and growth portfolios, which differ in their risk and return profiles. Understanding these options is crucial because the choices you make can affect the size of your super balance when you retire.

- Conservative options, typically comprising bonds and cash, offer lower risk but also lower returns over the long term.

- Balanced options mix assets like stocks and property with bonds and cash, aiming for a moderate risk-return balance.

- Growth options are heavily weighted towards stocks and property, carrying higher risk but offering the potential for higher returns over the long term.

How Much Super Is Enough?

Determining “how much super should I have?” is akin to asking “how long is a piece of string?”. The answer varies for everyone and depends on the lifestyle you envision for your retirement. However, the Association of Superannuation Funds of Australia (ASFA) provides guidelines for a modest versus comfortable retirement standard. For instance, to sustain a ‘comfortable’ lifestyle in retirement, couples aged around 65 need an annual income of approximately $62,000, while singles need about $44,000.

Using these figures, and considering average life expectancies, it’s estimated that a single person will need a super balance of around $545,000, and couples around $640,000 by the time they retire, to achieve a comfortable lifestyle.

Finding the Ideal Super Balance

While the “ideal” super balance varies depending on lifestyle, life expectancy, and retirement plans, aiming for a robust fund that will ensure comfort and stability in retirement is crucial. The Association of Superannuation Funds of Australia (ASFA) provides a quarterly measure of the cost of retirement known as the ASFA Retirement Standard. According to this standard, to maintain a ‘comfortable’ retirement lifestyle, singles aged around 65 should aim for a super balance of $545,000, while couples should target $640,000. However, considering inflation and increasing life expectancies, these figures should be viewed as a starting point rather than set-in-stone targets.

The Importance of Super Positioning

Your super is essentially your future in a fund. Recent research highlighted a concerning trend—22% of Australians haven’t checked their superannuation account in the last year. This detachment can lead to being unaware of how your super is performing, excessive fees, or inappropriate risk levels in your investment choices.

Not having enough superannuation later in life can have significant consequences, limiting your lifestyle choices, and possibly making you reliant on the Age Pension. Given the rising cost of living and life expectancy in Australia, your super balance plays a pivotal role in ensuring comfort and security in retirement.

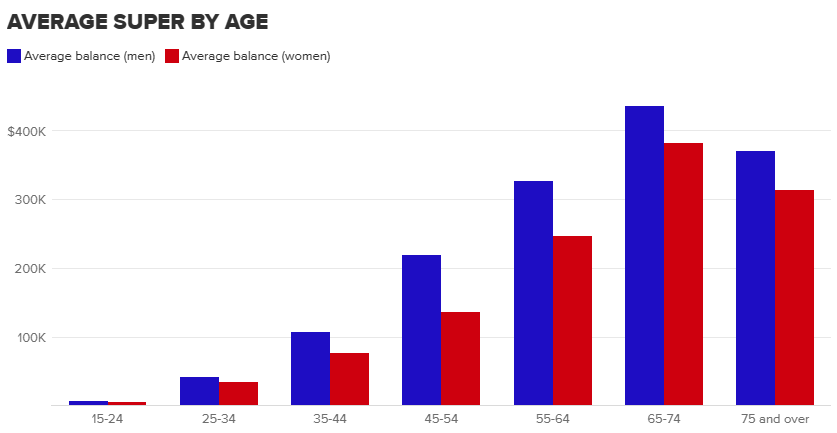

Source: Australian Bureau of Statistics (ABS), Household Income and Wealth, Australia 2019–20

Why You Need to Check Your Super Regularly

Regular checks and updates to your superannuation account can make a massive difference in the long run. By reviewing your super, you can:

- Ensure you’re in the right fund: Fees, performance, and investment options vary widely between funds. Make sure yours is serving your needs and retirement goals effectively.

- Consolidate your super accounts: Multiple super accounts mean multiple sets of fees and insurance premiums, potentially eroding your balance. Consolidating into one account can save you hundreds, if not thousands, of dollars in the long term.

- Review your investment options: Your investment strategy should reflect your risk tolerance and retirement timeline. Younger savers may opt for high-growth options, while those closer to retirement might choose more conservative investments.

- Maximise contributions: Consider if you can afford to make additional contributions, either concessional (before tax) or non-concessional (after tax), to boost your super balance. Government co-contributions and spouse contributions are also worth exploring.

The Journey to Retirement

Managing your super and understanding how much you need for retirement may seem daunting, but it’s an essential part of planning for your future. By engaging with your super early, making informed decisions, and seeking advice when needed, you’re mapping out a path that leads to a comfortable and fulfilling retirement.

Remember, the decisions you make today about your super will pave the way for your financial security tomorrow. Equip yourself with knowledge, take control of your superannuation investments, and step confidently towards your retirement goals. After all, it’s not just about surviving in your golden years; it’s about thriving.

If you would like to improve your current investment strategies or are looking to start your investment journey, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.

<a href=”https://www.freepik.com/free-photo/digital-increasing-bar-graph-with-businessman-hand-overlay_13312397.htm#fromView=search&page=1&position=4&uuid=73224a68-2d26-4cf3-9929-a43946b9df37″>Image by rawpixel.com on Freepik</a>