With access to up-to-date data on the performance of your portfolio, it’s natural to want to see how your investments are progressing. Especially now with poor market performance, it is normal to feel anxious, have doubts and start to question if it’s time to sell. But how frequently should we be checking our investments? Daily? Weekly? Monthly? Yearly?

In a survey conducted by Vanguard Australia, of the 1000 investors surveyed, approximately 28% of people checked their investments on a daily basis, with a similar figure checking weekly, equating to almost 60% of respondents checking at least once a week. Thus, the question is posed, how frequent is too frequent? And do frequent checks actually have any significant benefit for the health and performance of the portfolio.

This article will look into the importance of understanding the risk strategy for your investments and will delve into the role of time and compounding returns on the performance of your investments.

Understanding your risk strategy

Initially, it is fundamental to understand the level of risk within your portfolio as this will determine the volatility of your performance.

Let’s use the scenario of an investor with a 100% growth portfolio, they would experience higher volatility of their investments shifting price than an investor who may have a 50% growth and a 50% defensive portfolio. This is because a 100% growth portfolio is fully invested in the market and therefore completely exposed to the rises and falls of the market. Conversely, a portfolio which has 50% of assets invested defensively, will mean that a portion of assets are generally more protected from these market movements and are far less likely to be as volatile.

As a general guideline, the higher the risk, the less you should check. The reason why we recommended it’s not the best idea to check your returns on a high-risk portfolio too frequently, is because with such volatility its very easy to feel emotionally invested and make a rash decision, where you may make an impulsive decision to sell at a price that may decrease your potential returns.

Time

Generally, its observable that the market tends to balance itself and volatility caused by events such as negative press, the implications of COVID-19 etc. usually stabilise over time. This notion is supported by the economic cycle, a concept you may already be familiar with. In essence, it refers to fluctuations in economic activity, having 4 key stages: expansion, peak, contraction, and trough. As an investor, it’s important to understand that the market cannot remain expansionary, meaning it cannot keep increasing. There will come a point where the market reaches a peak and then will have to contract. The logic is the same if the market is contracting, it will reach a through and eventually have to expand. Key factors influencing the changes in the economic life cycle are the market forces of supply and demand, however if the market is too volatile, the Reserve Bank can intervene and change the cash rate to consequentially incentivize consumer spending or saving. Resulting in more stability in the market. Time should therefore be considered an asset and putting some trust in time has proven to be beneficial.

Compounding returns

But if you are ever in doubt, the one thing you can rely on is the power of compounding returns.

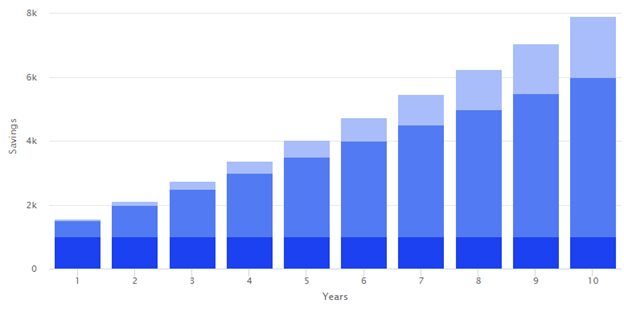

Compounding returns essentially refers to the rate of return of your investments over a consecutive period. It facilitates growth over the long-term, seeing a greater proportion of interest earned as visually expressed in the diagram below. Therefore, if you are worried about potential poor rates of return over the short term, you can feel a little bit better knowing that time is an asset in generating returns.

For example, if you invest $1000 initially, and deposit an annual $500 following your initial deposit, after a 10-year period with 5% returns, you can expect to have a total savings amount of $7,918, making $1,918 in returns.

Therefore, investors who keep their investments over a longer period of time, and hold through the volatility of the market, have a greater probability of yielding higher returns than an investor who takes a short-term approach to timing their purchases and trading of their investments. Hence, by reducing the amount you look at your investment returns, the less likely you will have doubts and make impulse short-term decisions that will have long term consequences.

If you would like to improve your current investment strategies or are looking to start your investment journey, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.

<a href=”https://www.freepik.com/free-photo/bearded-male-organizing-his-tasks-using-sticky-notes_13086675.htm#page=4&query=man%20thinking&position=11&from_view=search&track=sph”>Image by wayhomestudio</a> on Freepik