Most people don’t begin to consider retirement until they are about to leave their jobs or are forced to. Planning and saving for a happy and financially secure retirement is very important. A little preparation can go a long way toward ensuring that you are both financially and emotionally prepared for the journey ahead.

At what age do I have to retire?

In Australia, there isn’t a set retirement age, therefore you can retire whenever you wish. However, when making the decision of when to retire, it’s important to consider at what age can you access your superannuation.

You are able to withdraw your super when any of the following are met:

- When you turn 65 years (once you have reached this age you do not need to be retired).

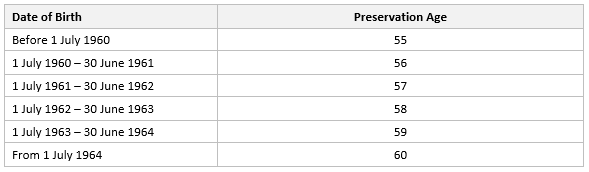

- When you retire and reach preservation age (refer to Figure 1 to see age requirements)

There are a limited number of ways that you may be able to access your super early, to find out more click here.

Figure 1 – Preservation age

Why do people retire?

Although deciding when to retire is a personal choice, most people’s decisions seem to be influenced by five typical factors. These are important to bear in mind because they frequently lead to the choice to retire earlier than anticipated.

- Health – There may be a health concern or issue that prevents you from performing your job. Additionally, you may decide to retire for care taking purposes.

- Work – As you age, the duties of your job may become more taxing, or you can find yourself out of a job due to redundancy or the end of a work contract.

- Friends and family – If your friends or family members are content in retirement, retirement can seem enticing.

- Financial independence – After your children leave home you may find that you have additional funds to spare or more money than anticipated.

- The right time – It may simply just feel like the appropriate next stage in your life.

How much money will I need for retirement?

Depending on the lifestyle you desire, you’ll need a certain amount of super. A general guideline is that, if you own your own house, you’ll need to make two-thirds of your pre-retirement salary in order to maintain your current standard of life.

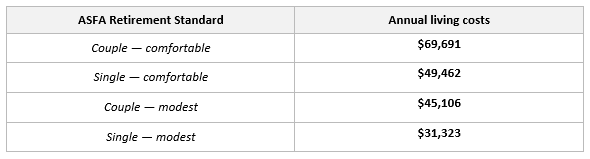

An industry retirement standard is offered by the Association of Superannuation Funds of Australia (ASFA). This provides an estimate of your financial needs based on your lifestyle.

Figure 2 – Budgets for various households and living standards for those aged 65-84

Source: ASFA (December quarter 2022, national)

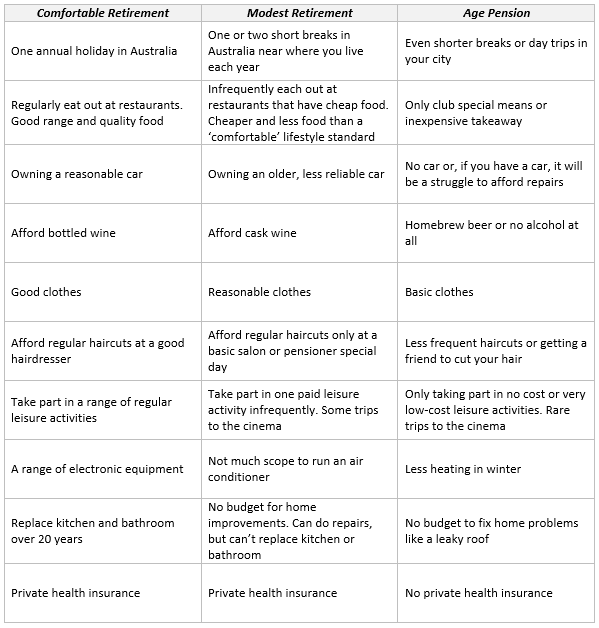

According to ASFA, a couple would need $690,000 in a lump sum at retirement, while a single individual will need $595,000 in order to maintain a good standard of living. This assumes you are receiving a partial-Age Pension. According to ASFA, the Age Pension covers the majority of the costs of a moderate lifestyle that includes the essentials. They calculate that a single person or couple would need a lump amount of $100,000 to support a moderate lifestyle. The type of lifestyle that singles and couples can have with various types of retirement is also shown in the table below.

Figure 3 – Lifestyles associated with different types of retirement

Source: ASFA

If you would like to improve your current investment strategies or are looking to start your investment journey, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.