What does a financial adviser do?

Do you need help managing your money? A financial adviser is someone who can assist you to meet your financial goals and objectives by providing specific and individual advice tailored to your circumstances. Irrespective of the stage you are at in life, whether this be saving for your first home, your children’s future, investing your money or planning your retirement or estate needs, a financial adviser can provide valuable advice to guide you through these financial and life changes.

When it comes to providing financial advice, an adviser should be working in your best interest by providing unbiased strategic and product investment advice. Even more importantly a good financial planner should make sure you stick to your plan despite market volatility and always keep you disciplined in how you react to different life and market events, and what you must do to accomplish your goals.

This advice should be based off their financial expertise, industry experience and knowledge of varying financial products including Insurance, Super platforms, and investment strategies. This will then be modelled based on your current and projected income, budget, and financial needs. The advice should also consider current legal regulations and legislation which may impact the proposed strategy. When getting advice, you want to have different options and make sure the numbers being modelled assist you to make the best decision. A good financial planner should be able to help you with this. Remember, modelling and figures should provide you with more certainty to make an informed financial decision to accomplish your goals.

How do I know if I need a financial adviser?

Research has found that receiving financial advice has positive effects on a client’s financial and general well-being, with respondents suggesting they experienced an increase in their sense of security, control and peace of mind. A study by Russell Investments also found that engaging with a financial planner has the potential to increase an individual’s returns by up to 3.75%, and therefore, obtaining financial advice can be highly advantageous if you do not have the time, knowledge, discipline or patience to look after your own finances. If this is you, a financial adviser can help you understand and implement tailored strategies and investment techniques to get on top of your finances. It is vital that you communicate your current position and where you would like to go, this way, your adviser can provide you with the most relevant and appropriate advice. The following list contains the areas which a financial adviser can provide advice on:

- Cash flow management – comparing your income with your expenditure.

- Debt management – helping reduce your financial burden by monitoring your current debt management.

- Insurance – conducting an insurance needs analysis to determine the most appropriate level of cover.

- Investment (including super and pension) – developing an investment strategy to assist you in achieving your needs and objectives.

- Social security and aged care planning – determining the optimal claiming strategy and how to maximise your social security entitlements.

- Estate planning – ensuring your estate plan reflects your distribution objectives and the distribution of your wealth.

- Self-managed super funds (SMSF) – for individuals seeking to gain greater control of their superannuation portfolio, SMSF may be an attractive alternative to conventional superfunds.

How do I choose a financial adviser that is right for me?

When choosing your financial adviser, it is crucial to choose someone who understands you and who you can trust. If you don’t have a good gut feeling, follow that instinct. There are three main steps which you can undertake to help you find the right financial adviser.

- Conduct primary research – ask friends, family or colleagues.

- Carry our external searches – Google, financial publications, company websites.

- Try before you buy – schedule two or three interviews and make comparisons.

Your first port of call should be to ask your close friends, family or colleagues if they have a financial adviser or wealth management firm they recommend. Word of mouth is one of the most reliable sources of information, especially coming from someone you trust.

Once you have conducted this primary research, use other sources such as Google, financial publications such as Canstar and Business Insider as well as visit the websites of various financial planning companies. This will provide you with a good sense of the different areas of advice that each firm offers and what they specialise in, which should align with your needs and objectives.

Finally, it is important to talk to some potential financial advisers to see if they have the relevant expertise, are someone you can trust and most importantly someone you click with. The better the first impression the more likely your relationship with your adviser will be a successful one. If it doesn’t feel right, try somewhere else.

If you would like to book in with an EPG Wealth adviser for a complimentary chat, click here.

Where to from here?

Initially, engaging with a financial adviser is a thorough and timely process. However, time and energy spent in these early stages will establish solid foundations for a positive and successful experience with your adviser, now and far into the future. It is crucial that you clearly communicate your specific needs and objectives so that the financial adviser can recommend the most appropriate and suitable strategies for you.

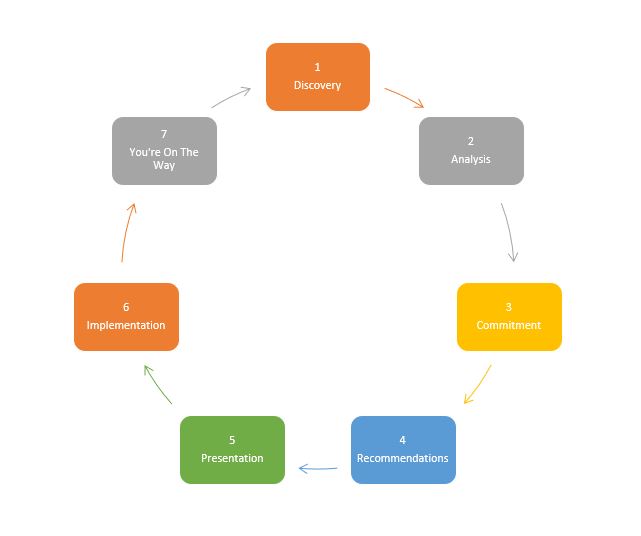

The following diagram outlines this process:

The process

The discovery stage involves a meeting to understand if the adviser will be able to provide value and assist you with your finances. If your adviser does not take the time to truly understand your financial position, consider shopping around. As much as the adviser is scoping out whether they can provide you with the assistance you are seeking, it is also just as important for you to determine whether they are the right fit for you. Following this, further analysis is conducted to help you to define your goals and expectations which includes explaining the process to ensure you understand what it entails. At this stage you will also be required to provide some paperwork so that your adviser can proceed to the next step. The more detail that is provided during this stage, the better picture your adviser will have of your circumstances, hence enabling them to offer the best advice.

Once this is completed, your adviser will provide you with an engagement letter to outline the services being offered and the associated costs which will depend on the scope of the advice. Recommendations will then be made which are tailored to you based on your specific financial objectives, these are then presented and explained to you in a Statement of Advice to ensure you understand the different components. At this stage, you should take the plan with you, read over it and confirm the suggested approach. If you would like to make any changes, it is vital you communicate this with your adviser. Once this has been completed, the strategies can be implemented, and you have begun your financial planning journey.