You may have heard of a Self-Managed Super Fund (SMSF) but not really known how they work. A SMSF can offer many benefits, however, it is also essential that those who wish to manage their own super know the array of risks and costs associated with taking this approach. To find out whether this could be an appropriate strategy for you, please read the article below.

What is a SMSF?

An SMSF is a private superfund that you establish and manage independently. Instead of part of your salary or wage being allocated to a retail, industry or wrap superfund, it is instead put into your SMSF which is structured as a trust in the same way.

What are the characteristics of a SMSF?

An SMSF can have up to six members which are trustees of the SMSF. This means that the money and investments within the fund are held on trust for these individuals by the SMSF, and they are also responsible for managing the investments and insurance products within it. The Australian Financial Review has suggested that every year around 60,000 Australians set up an SMSF, with more than 1 million Australians currently managing an SMSF, however, many individuals still do not know how they work. It is important to note that these structures are not suitable for all individuals as they can be highly complex, and trustees must comply with a range of stringent requirements.

What are the benefits of an SMSF?

There are a range of benefits associated with an SMSF including that trustees have full control over the investments within the superfund. This allows the holdings to be specifically tailored to your needs and objectives and may enable trustees to have access to a wider range of options compared to industry or retail funds. SMSF members have access to products both publicly available to other superfunds as well as those that are not. An example of this is members who wish to invest directly in real estate. If an investor with a public superfund wished to invest in real estate this would most likely occur through a property ETF or property trust, however, this could be a direct investment through an SMSF.

SMSFs can also provide significant tax benefits to trustees. Where trustees are compliant with super legislation, this affords the SMSF members the entitlement to have their contributions and earnings taxed at the super rate of 15% up to certain limitations. In addition to this, any benefits received after the age of 60 are also tax free which is an incentive for many investors as this could decrease your tax bill significantly, especially when nearing or in retirement. When a SMSF is converted to a pension, the pension payments that members withdrawal are also counted as tax free income, similar to an account that is operated by a superannuation institution. It should be noted that these taxation benefits are not just unique to SMSFs and are available to all individuals with a super account, however the difference is that there is a greater degree of tax flexibility around capital gains, taxable income, and franking credits.

What are the risks and responsibilities?

There are a range of risks and responsibilities associated with this form of superfund. If you do not want to actively manage your finances and you are not organised with paperwork and actively remain up to date with regulatory changes, this may not be the best option for you. Trustees are also responsible for the fund’s decisions as well as ensuring these decisions are compliant with the law.

This includes the following:

- You are personally liable for all the funds decisions – obtaining assistance from a potential does not reduce or exempt you from liability

- The investments you choose may not produce the expected returns

- You will continue to be responsible for the SMSF even if there is a significant change in your circumstances

- If a relationship breakdown occurs this may have a negative impact on the SMSF

- If money within the SMSF is lost as a result of fraud or theft, members of the SMSF will not have access to special compensation schemes of the Australian Financial Complaints Authority (AFCA)

- You may risk losing your insurance if you move from an industry or retail super fund to establish your own SMSF

What is involved in managing an SMSF?

There are a vast arrange of duties involved in managing and operating an SMSF, and therefore it is highly time consuming. This involves firstly establishing the SMSF structure and includes completing paperwork and other required documentation. The SMSF also requires ongoing management and includes:

- Conducting research around the investments you would like to purchase

- Establishing, implementing, and remaining disciplined to an investment strategy that reflects the members’ desired level of risk

- Accounting, maintaining records and arranging an annual audit by an approved SMSF auditor

Moneysmart.gov suggests that SMSF trustees spend on average eight hours per month to manage their SMSF, which equates to more than 100 hours per year.

What are the costs of operating an SMSF?

There are a range of costs associated with managing an SMSF. These include the following:

- Investment costs

- Accounting costs

- Auditing costs

- Taxation advice

- Legal advice

- Financial advice

It has been estimated that the average cost of running an SMSF was around $6,450 per year.

What professional knowledge is required?

It is also vital that trustees of an SMSF have the requisite financial and legal knowledge to manage this trust structure in a legally compliant and financially viable manner. This includes:

- Having an adequate understanding of various markets and how to build and manage a diversified portfolio

- Implementing an investment strategy that mirrors your risk appetite and ensure you are able to meet your retirement needs and objectives

- Comply with the array of taxation, super and investment legislative requirements

- Organise insurance products for fund members

How well do SMSF performs?

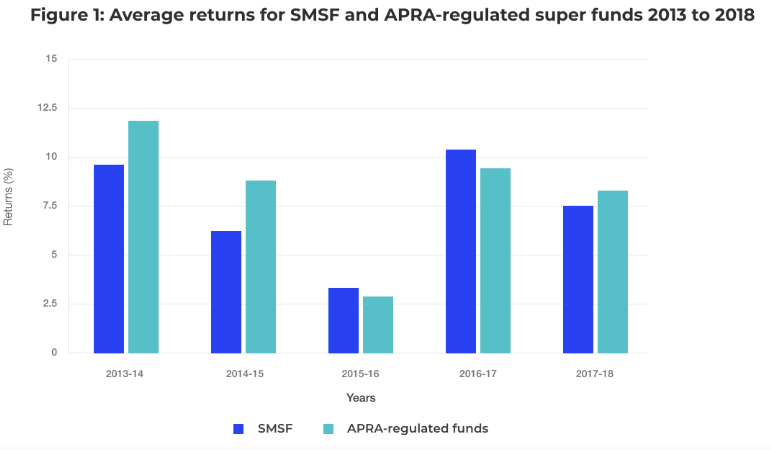

Historical data suggests that SMSFs have not outperformed retail or industry super funds that are regulated by APRA. This is mainly due to the abilities of highly skilled professional that oversee and manage the superannuation of thousands of Australians. The graph below outlines the performance of both SMSFs and APRA-regulated funds.

Source: Moneysmart.gov

Who should set up an SMSF and how should they do it?

To establish an SMSF it is important that trustees have enough money to ensure that it remains a viable investment once the fees and costs are deducted. The exact amount of money required will depend on a range of factors, the individual’s level of involvement in the decision-making process and the contributions being made to the fund. It is essential that the various costs and fees are budgeted for to ensure that they do not significantly diminish investments returns and in turn prevent you from achieving your goals and objectives in retirement. Therefore, SMSFs are the most appropriate for individuals who have:

- The time to establish, oversee and manage the SMSF

- Have a detailed understanding of the various compliance requirements including the tax, investment, financial and legal requirements and remain informed when they are amended

- Have a clear understanding of their investment strategy and how to implement and maintain it overtime

- Have a sufficient amount of money to ensure it is a viable superfund to set trustees up for their retirement

If you are thinking of establishing an SMSF, would like to know more or have one in place and would like tailored financial advice, please click here to organise a complimentary 20-minute meeting with an EPG Wealth adviser.

This information is purely factual in nature. Please do not rely on this information to make any financial decisions as this information has not been tailored to your personal. circumstances. If you would like financial product advice or services please let me know and I will set up an appointment for you. Any advice in this email is of a general nature only and has not been tailored to your personal objectives, financial situation and needs. Before acting on this advice, you should consider whether it is appropriate having regards to your personal objectives, financial situation and needs. Before making a decision to acquire a financial product, you should obtain and read a Product Disclosure Statement (PDS) relating to that product, it is important for you to consider these matters and to seek appropriate advice. The material contained in this email is based on information received in good faith from third party sources, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Past performance is not a reliable guide to future returns. Licensee EPG Wealth Pty Ltd 529273 – associated employees or agents may have an interest in or receive monetary or other benefits from the financial products and services mentioned in this email.

https://www.freepik.com/free-photo/coins-bottles-with-trading-graph_5508872.htm#query=managing%20finances&position=45&from_view=search