As tax time and the end of financial year approaches, the age-old debate between super and property continues to heat up amongst investors seeking to maximise returns and minimise tax. The following article will outline the differences between investing in super and property, the best ways to minimise your tax bill and the characteristics of each investment to help you to determine the best investment for you.

What is superannuation?

Superannuation is the money an individual puts aside during their working years to fund their lifestyle in retirement. Super represents one of the largest pools of assets in Australia and as of March 2022 is valued at $3.4 trillion, and has risen by 9.7% over the last 12 months. Contributing to your super early is a viable way to boost you super balance and helps to ensure you achieve your financial goals and objectives by retirement. Maximising your super contributions in addition to the Superannuation Guarantee (SG) made by your employer also offers tax savings which will be discussed below.

How does this compare to investing in property?

The Australian Financial Review argues that Australia has a ‘national obsession with residential property’ with Australia’s housing market now worth over $8 trillion. This is approximately four times the size of Australia’s GDP, and around $1 trillion more than the value of the ASX, superannuation and commercial real estate combined. Notwithstanding this, investing in property whether residential or rental offers a range of benefits including capital growth and potentially income.

Choosing to purchase an investment property can provide investors with positive cash flow and potentially tax deductions, with the view of reselling the property at a higher value that what you purchased it for. Prior to making any decision it is important to consider the benefits, risks and costs associated with your investment options.

Super vs Property?

It must first be acknowledged that comparing super and property is similar to comparing apples and oranges as property is an investment whereas super, although it is invested, it is a trust structure that holds the assets on trust for the benefit of the member. However, it is still important for investors to conduct comparisons to determine the best investment strategy for them.

The performance of both investments is contingent on wider economic conditions and how both property and super fare over the long term is based on market growth and downturn. Super is a long-term investment as investors cannot access their super until retirement age or until they meet certain conditions of release. This means that short term declines and market volatility are unlikely to impact your super over a long-term period.

However, with property, declines in the market can impact both rental yield as well as the value of your property which is often based on the law of supply and demand. Similarly, to other investments and markets, the property market also experiences cycles of ups and downs, but it is important for investors to keep in mind that purchasing or selling property should be timed based on market conditions. It is a good idea to conduct extensive research to understand your time horizon, debt management and other factors to help ensure that your investment property is a viable one.

On the other hand, super offers investors the opportunity to diversify their assets which refers to the allocation of your super into different classes which can reduce the impact of volatility on your portfolio. With property, diversification is not as achievable as unless you have an extensive portfolio you only hold one asset, your property, and therefore you are fully exposed to changes in that market. Therefore, it is important for investors to look at their risk appetite and tolerance to determine the most appropriate strategy for them.

Each investment also has their individual tax benefits and drawbacks which investors need to weigh up before making any decisions. Superannuation is generally taxed at 15% up to an annual limit of $27,500. This is particularly important for those Australians that earn over $45,000. Why this number? Above this income threshold, investors can expect to pay 34.5¢ in the dollar in tax (including the Medicare levy of every 2¢ in the dollar). However, this money when allocated to super provides a tax saving of 19.5¢ in the dollar. Please note individuals with a combined taxable income that exceeds $250,000 do not receive the 15% tax concession and are taxed 30% up to $27,500. To read more about Division 293 tax, click here.

For those earning income over $120,000 and allocate $27,500 to super, this provides a tax saving of 24¢, and 32¢ for those earning over $180,000. This is to incentivise Australian to maximise and build up their super balances prior to retirement and also provides a viable way to reduce your annual tax bill. It should also be noted that if your super becomes an Account-based pension in retirement, this income is completely tax free! It is also possible to access unused contributions from previous years back to 2018-19 and helps those who have yet to make use of these concessions to boost their super balance.

Investment properties also provide Australians with tax benefits including interest charged on loans, and rental expenses which can be offset against your tax payable and reduce your tax bill. As buildings and the fittings inside depreciate, the depreciated value can be claimed as a deduction called a ‘non-cash deduction.’ There are a range of other costs and fees that can be offset and therefore this can provide Australians with considerable tax savings.

What about returns?

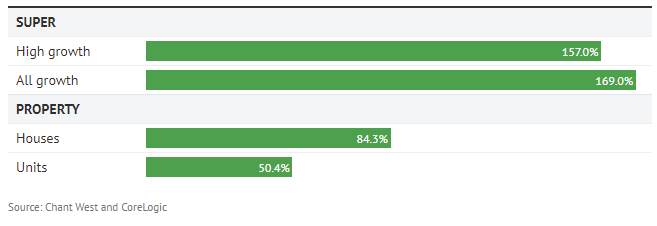

A crucial aspect of investing is the returns certain assets generate. It should be noted that super has generated a 157% cumulative return over the past decade if invested in a median high growth option, and a 169% return if invested in a 100% growth option. Conversely, Australian house prices rose 84.3% over the last decade, which is just over half the growth of a high-growth super.

Therefore, when deciding between investing in super or property, it is vital that investors both young and old look at the array of costs, benefits, risks and tax implications prior to making any decisions that are likely to have a significant impact on your financial future.

If you would like assistance determining the most appropriate strategy for you and your circumstances, please click the link to receive a complementary 20-minute consultation with an EPG Wealth adviser.