“Don’t sail out farther than you can row back.”

This Danish saying is sound advice for anyone thinking of borrowing to buy a home.

According to research conducted by the Centre of Policy Development and the University of Canberra, Australians show a tendency to be over-confident in their ability repay debt, as well as underestimate the possibility of unexpected life events.

It is likely that you, or someone you know have said, “I’ll be able to repay my loan, provided I keep my job, don’t get sick and I’m not hit with any large unexpected bills”? However, things can and often do go wrong.

Causes of Mortgage Stress

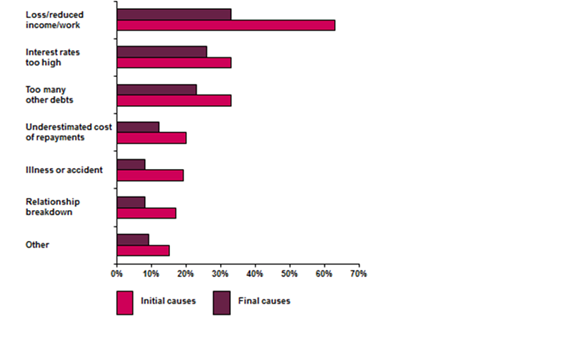

Research from the Royal Melbourne Institute of Technology (RMIT) showed the specific triggers that have led to Australian households being unable to meet their mortgage repayments as they fall due. This included the initial causes, if they changed, and what the final causes were. They were also able to identify more than one cause. The graph below shows the results.

How to Reduce Mortgage Stress:

Borrowing is often associated with being a high stress exercise, however, below are a few tips that can be implemented to help reduce the angst.

- Build up a buffer: Building up or holding a cash reserve in a mortgage offset account is a strategy that will provide a buffer which can be utilised to meet loan repayments in the chance you become ill or are unable to continue working.

- Take out personal insurances: It is vital that the income which services your debts is not compromised by certain events beyond your control. This can be achieved by ensuring you have adequate personal insurances. This includes:

Insurance Type Purpose Income Protection Insurance This can replace up to 75% of your income if you are unable to work due to illness or injury. This can ensure you are able to continue meeting the majority of your living expenses, not just your loan repayments. Critical Illness Insurance This can help you service or pay off your loan and meet a range of expenses in the event you suffer a specified illness, such as cancer or a heart attack. Total Personal Disability Insurance This can help you service or pay off your loan and provide an ongoing income if you become totally and permanently disabled. Life Insurance This can be used to service or pay off your loan and provide your family with an ongoing income if you pass away. - Take out mortgage protection insurance: Many lenders offer insurance when you take out a home loan that covers the mortgage (often up to a specified amount and for a particular period of time) if you die, become disabled or your employment ends involuntarily

- Fix the interest rate: Another way of providing protection is through fixing the interest rate on your home loan to provide protection against rising interest rates. A negative aspect of this form of protection is that there are often restrictions on making additional payments into a fixed rate loan and therefore would limit your capacity to build up a buffer. A viable choice is to find a combination of fixed and variable rate loans, as additional repayments can be made into the variable rate portion of the debt.

- Don’t add fuel to the fire: It is estimated over 40% of survey respondents with a mortgage used credit cards more often than they normally would, and it has been found that using debt to service debt is very likely to compound the problem.