Mergers and acquisitions (M&A) involve financial transactions including mergers, acquisitions, consolidations, tender offers, asset purchases and management acquisitions with the primary objective to consolidate companies or their major business assets.

Mergers and acquisitions are terms that are often used interchangeably; however, they do hold some key differences. Acquisitions refer to when one company purchases another company and establishes itself as the new owner. Whereas, mergers occur when two firms, typically of similar sizes decide to combine into a new single entity under one commercial name.

BHP Petroleum merger with Woodside

On 1 June 2022, BHP Petroleum’s gas and oil portfolio merged with Woodside to become the largest listed Energy company on the Australian Securities Exchange (ASX). The synergy between both BHP and Woodside is projected to expand the scale and diversity of their markets.

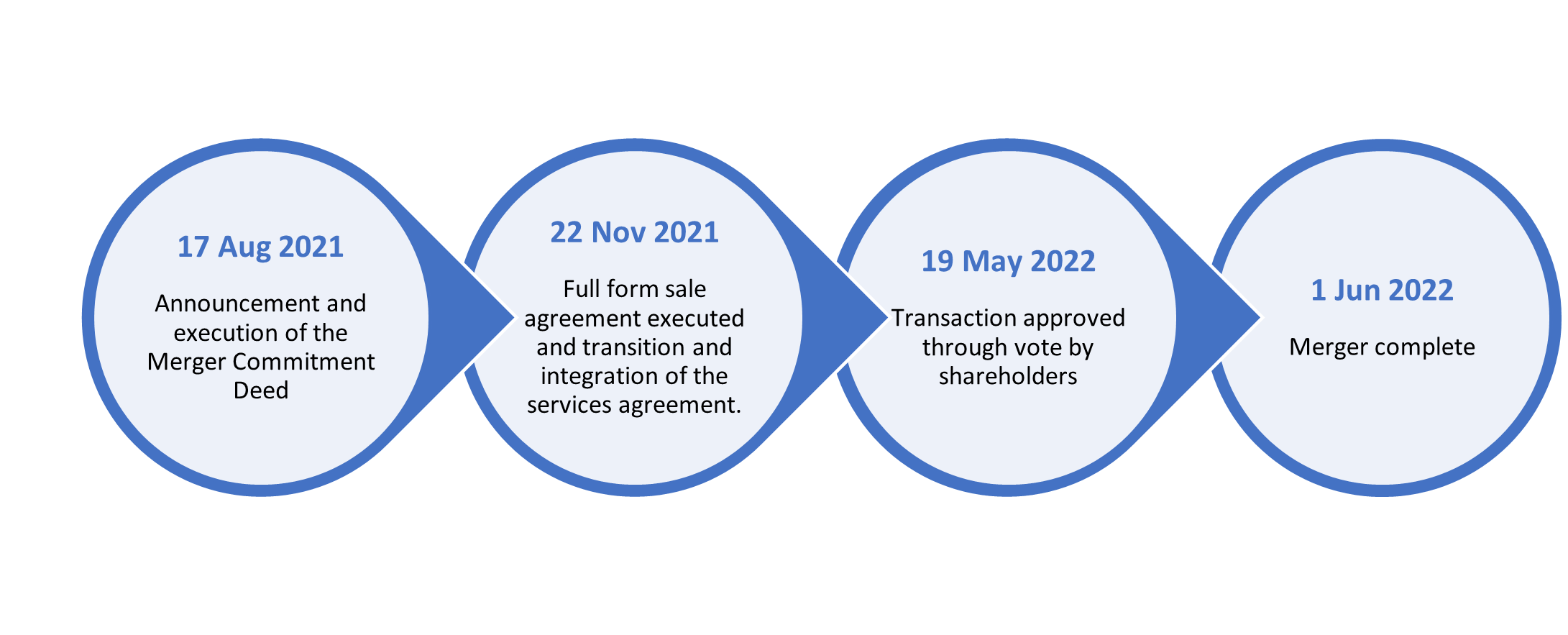

Timeline of Key Events

Why did they merge

Oil and gas are the primary source of energy in Australia, with oil accounting for almost 39 percent of energy consumed and natural gas closely following with 26 percent in 2018-19.

With such a large market, the merger of BHP’s petroleum assets with Woodside has facilitated value creation for stakeholders of both businesses, with increased scale and diversification of their market, products, and geographies. The combined businesses are expected to be able to better fund investments that support the transition of energy in the future and have greater financial resilience.

“Woodside and BHP’s respective oil and gas portfolios and experienced teams are better together. The combination will deliver the increased scale, diversity, and resilience to better navigate the energy transition.” Meg O’Neill, CEO and Managing Director

Implications for investors

Following the merger, on 1 June 2022, Woodside provided BHP with 914,768,948 Woodside shares as consideration for the sale.

BHP distributed these shares to their shareholders, by determining a fully franked in specie dividend. An in-specie dividend refers to a dividend which is paid through assets, in this case as Woodside shares.

Eligible shareholders of BHP received 1 Woodside share for every 5.5340 BHP share they held as of on 26 May 2022. The Woodside share price increased from US$15.16 to US$21.39, from the 17 August 2021 to 31 May 2022 respectively. For BHP shareholders, the merger allowed them to share these positive returns with Woodside shareholders.

Following the merger, the Woodside share price on 1 June 2022 was approximately 30.19 AUD and as of today, 29 November 2022, the share price is approximately 35.89 AUD. Over the same period, the S&P/ASX 200 has decreased in share price by roughly 3 percent, indicating that Woodside has outperformed the ASX 200.

If you would like to improve your current investment strategies or are looking to start your investment journey, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.

This information is purely factual in nature. Please do not rely on this information to make any financial decisions as this information has not been tailored to your personal. circumstances. If you would like financial product advice or services please let me know and I will set up an appointment for you. Any advice in this email is of a general nature only and has not been tailored to your personal objectives, financial situation and needs. Before acting on this advice, you should consider whether it is appropriate having regards to your personal objectives, financial situation and needs. Before making a decision to acquire a financial product, you should obtain and read a Product Disclosure Statement (PDS) relating to that product, it is important for you to consider these matters and to seek appropriate advice. The material contained in this email is based on information received in good faith from third party sources, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Past performance is not a reliable guide to future returns. Licensee EPG Wealth Pty Ltd 529273 – associated employees or agents may have an interest in or receive monetary or other benefits from the financial products and services mentioned in this email.

<a href=”https://www.freepik.com/free-photo/business-people-shaking-hands-meeting-room_2770460.htm#query=merger&position=15&from_view=search&track=sph”>Image by rawpixel.com</a> on Freepik