Self-managed Super Fund (SMSF)

Background

A Self-managed Super Fund is a super fund consisting of 4 or less members, all which are trustees and have direct control over their retirement savings and investments. According to the ATO, although less than 5% of Australians hold an SMSF, SMSFs account for 27% of the $2.7 trillion invested in superannuation.

Advantages of SMSFS

There are various reasons as to why people would want to invest in an SMSF:

• You have greater control of your investments, so you can respond to changes in the financial market and superannuation rules

• You have an access to a broader range of investments such as high yielding cash accounts, international markets, cryptocurrency, direct property and collectables

• You have greater tax benefits as members have full control over the timing of contributions and the allocations of earnings

Does an SMSF suit you?

Before deciding to set up an SMSF, there are various questions you have to ask yourself:

1. Are you willing to commit the necessary time and effort?

Members are personally responsible for all aspects of the fund’s operations, so this means being involved with the administration, researching investments, creating and monitoring an investment strategy, and ensuring legal and tax obligations are met.

2. Do you have the expertise?

A high level of expertise is required for members to choose investments and manage investment risk. It is only ideal to set up an SMSF if you have extensive knowledge of financial and legal maters and are confident that the investments you choose will outperform those chosen by your professionally managed fund. If not, you must make sure you can afford to pay experts to help you manage your investments.

3. Do you have sufficient money in superannuation to make it worthwhile?

There are high costs involved in the establishment and running of an SMSF. Most SMSF funds cost between $650 and $3,500 to establish depending on the fund’s structure, trust deed and the professional advice needed. Annual fees such as those required for audit, insurance and financial advice, average between $1,500 and $5,000 depending on the complexity of investments.

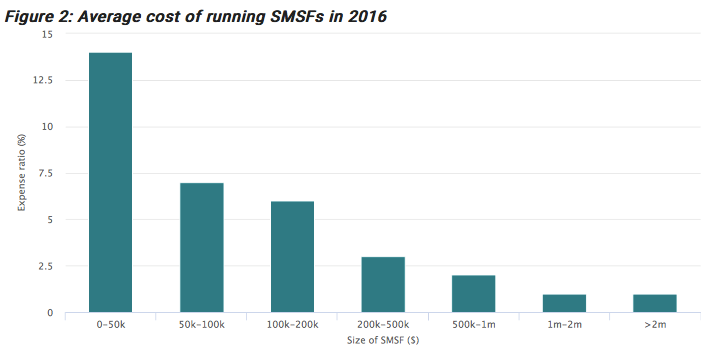

The above figure from the ATO shows the average total cost of running an SMSF in 2016 as a percentage of the fund’s balance, otherwise known as the expense ratio. In comparison, average expense ratio for all APRA-regulated funds was 0.8% as of June 2017.

Whilst there is no minimum balance restriction for setting up an SMSF, the ATO and ASIC estimate that to be cost competitive with other funds, SMSFs should have investments of at least $200,000. However, many financial advisors suggest that a balance of $500,000 is required in order to really maximise the benefits of establishing an SMSF.

Professional Guidance

Professionals who are licensed to provide SMSF advice can help you weigh up the pros and cons of running an SMSF and help decide whether it is right for you. They can also help with administration and investment decisions; however, it is important to remember you are personally liable for all the decisions made by the fund.