Crypto and digital currencies are all the rage at the moment, with over 300 million people using or owning crypto worldwide as of 2021, and over 18,000 businesses already accepting cryptocurrency as a form of payment. Choosing to invest in this form of asset is a decision that only an investor can make themselves, however, this article will provide information about how digital currencies work and some of the considerations you may wish to take into account when making your decision.

What is Cryptocurrency?

The Reserve Bank of Australia defines cryptocurrency as ‘digital tokens’ or ‘a type of digital currency that allows people to make payments directly to each other through an online system.’ It only exists in the online realm and is not recognised under legislation as something with intrinsic value. Hence they are ‘simply worth what people are willing to pay for them in the market.’

This can be contrasted with national currencies which derive their value from being identified as ‘legal tender’ under the Reserve Bank Act 1959 and the Currency Act 1965. This is what gives Australian coins and banknotes their value today.

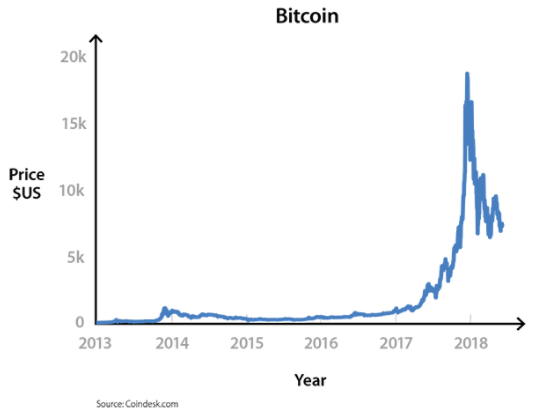

Interest in digital currencies has increased considerably since it was invented in 2009 which is mainly due to its speculative nature and that investors are likely to buy digital currencies to make a profit rather than use the coins to make payments. This has resulted in high levels of volatility which was highlighted by the exponential rise and fall of the value of bitcoin. Around the start of 2017, bitcoin’s value jumped from USD 1,000 to USD 20,000 and then fell to around USD 7,000 just 12 months later.

Despite the significant interest in this form of currency, industry and financial experts are still highly sceptical about their role in mainstream investing, finance and banking and whether they will ever replace traditional currencies.

How do they work?

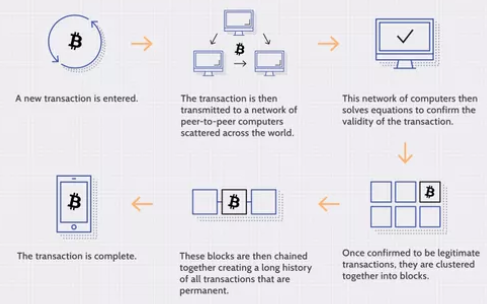

Bitcoin and other cryptocurrencies are supported by a system or technology known as the blockchain. The blockchain collects information and groups it together in sets which are known as blocks. It is predominantly used as a ledger for transactions that provides an exact timestamp of when each transaction is added to the chain.

For example, if Larry wants to transfer some crypto to his friend Garry this information is grouped in with other recent transactions within a block. This block is then transformed into a cryptographic code. Cryptocurrency miners will ‘mine’ to find the right code and will add the said block to the blockchain, which is a chain of similar data. Once the code has been found, the block is added and the transaction is verified, and thus Garry will receive the cryptocurrency from Larry.

The benefit of the blockchain is that it provides a record of data and greater security for cryptocurrency users to protect themselves against being scammed or their data being corrupted. However, there is no trusted third party such as a government or central bank that can regulate or oversee the circulation of cryptocurrency and therefore it is an extremely risky investment choice.

What are the risks of investing in Cryptocurrency?

If you are thinking about investing in crypto, like all financial decisions it is very important to consider what the potential risks are before you decide whether digital currency is the right course of action for you.

As aforementioned, cryptocurrencies are not regulated and are unlike traditional finance markets, hence they are subject to exponential volatility in short periods of time. Unlike national currencies, crypto is not supported by a trusted entity such as banks or governments, and despite the blockchain providing some security, due to the anonymity associated with these transactions, there are significant risks about the potential to be scammed or have your trades invalidated.

Crypto is also one of the most volatile forms of investment currently available which is because the market is fueled by speculation and trades on rumours. This is not the case for traditional markets such as the ASX which is regulated both by government and financial institutions whereby companies are required to disclose material information to the market to ensure that all investors have equal and timely access to information about a company. Conversely, a single negative tweet or news story can have a drastic effect on the value of cryptocurrencies.

Another risk for investors to consider is the potential for cyber theft, scamming and the hacking of transactions. This form of currency provides cybercriminals with an opportunity to potentially hack the blockchain and gain access to individuals’ crypto wallets and trading platforms. Therefore, posing a significant risk to both new and seasoned investors.

Although decentralisation of the crypto market may be appealing to some investors there are also many risks associated with this. In traditional transactions, if money is lost during an electronic transfer, it can usually be followed and found by a financial institution, and therefore chances of your money being lost are low. This is not the case for crypto as it is often difficult to find the correct entity to dispute a transaction with. Hence, investors need to consider these varying risks before choosing to invest in this form of currency.

If you do not know where to start with investing and want to know the best course of action to take based on your financial circumstances and future goals, please click the link to organise a complimentary 20-minute consultation with an EPG Wealth adviser.