Whether you are an experienced investor or are just beginning your investment journey, being familiar with the long-term investment approach is pivotal to your investing success. This article will outline the meaning of long-term investing and the associated benefits of adopting this approach when investing in the stock market.

What is long term investing?

Long-term investing is an approach that encompasses holding certain investments for an extended period of time with minimal changes during both market downturn and market growth. This involves allowing your investment account to grow over many years instead of reacting to short term volatility or noise that occurs on a day-to-day basis. Being a long-term investor is often associated with bearing more risk and therefore increased returns as you have time to weather falls in the market. Below are some of the benefits of adopting a long-term approach when it comes to investing your hard-earned money.

Advantages of long-term investing:

In theory, the long-term investment approach should be less time consuming than investing for a shorter time horizon as individuals do not need to spend time monitoring day to day fluctuations in the market. Instead, they can focus on their strategy over a longer time frame such as 5-10 years and new investment products which may be suitable to their level of risk.

Another advantage of long-term investing is the reduction in transaction and implementation fees that are incurred when investing. Brokerage, buy and sell spread and capital gains taxes will increase exponentially for those investors that are constantly chopping and changing the assets they are invested in. You can expect to pay tax on the income you receive from your investments which is charged at your marginal tax rate. However, holding an investment for more than 12 months means you may be able to claim a tax concession.

Therefore, taking a longer-term perspective and holding investments for an extended period is likely to reduce your exposure to transactions fees in comparison to short-term or more erratic investors.

Another key benefit of long-term investing that attracts many individuals is the higher returns it often yields. According to a study conducted by Credit Suisse, Australian shares have given their investors an average annual return of 6.7% per year since 1900. The 2020/2021 financial year saw the ASX record its strongest fiscal performance since inception with a 24% return as of June 30, 2021. Thus, reinforcing that holding your investments for a longer time horizon gives you an unrivalled opportunity to capitalise on market returns.

In conjunction with this, long term investing enables investors to ride out market volatility which is an inevitable symptom of investing in the stock market. Market volatility refers to the degree to which a share price fluctuates over time. However, this concept must be contrasted with the permanent loss of capital which occurs when investors react to short term volatility and sell their investments at a loss.

Remaining invested over the long term ensures that investors do not react to these market downturns and therefore it is less likely they will realise a true loss. According to Bloomberg Data, individuals who invested for a 10 year period between 1984 and 2020 in FTSE 100 index had an 89% chance of making a gain. Hence, reinforcing the importance of remaining invested for the long haul.

Another advantage for investors to consider is the benefits of compound returns. This refers to the returns generated from well-performing funds or shares being reinvested and compounding an investor’s returns overall. Thus, allowing your money to grow at a faster rate than constantly buying and selling different investments in an attempt to enter and leave the market at the right time.

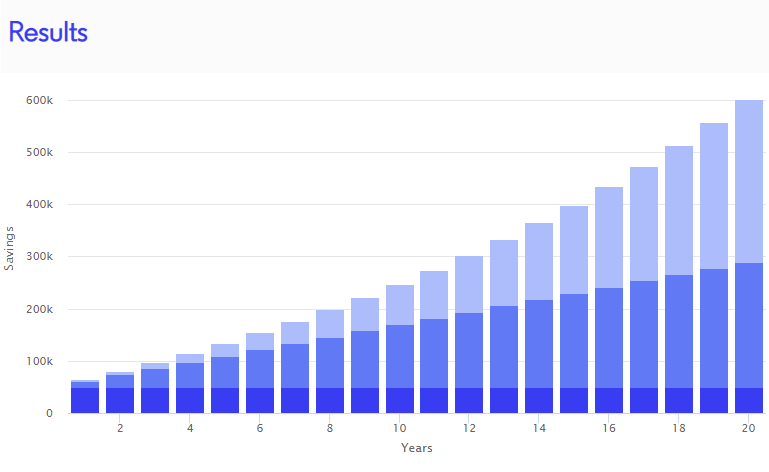

If you were to invest $50,000 today and contribute $1,000 every month, over a 20-year period at an annual rate of return of 6% p.a., by 2041 you would have $601,784, with more than half of this amount ($311,784) being made up of compound interest.

Finally, whether you are an avid investor or are about to make your first investment there are some key things to consider before making any further decisions. These include:

- Determining the level of risk you wish to bear – this should be based on how much you have to invest, your time horizon as well as your emotional response to market volatility.

- Your investment time horizon should consider any upcoming life changes such as buying a property or retiring which may require you to have liquid assets available.

- Short and long-term goals – your investment strategy and your respective time horizon should also consider your needs and objectives such as your cash flow requirements as well as other expenses or debt.

To read more about whether you should save or invest, click here. If you would like to improve your current investment strategies or are looking to start your investment journey, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.