It is easy to look at things with the benefit of hindsight once an event has passed and consider the range of options available to you at that time that now seem obvious. The following article will outline some tips that you can implement today to assist you to grow your wealth and reduce the chances of your future self-wishing you had the benefit of hindsight.

Compound Interest

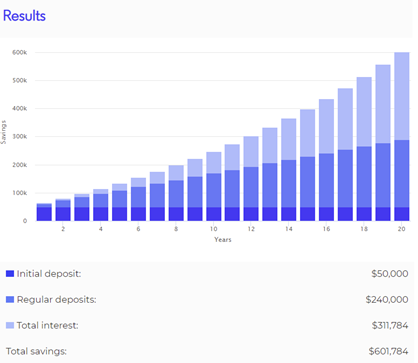

One of the major benefits of starting early is the advantage of compound interest. Albert Einstein once described compound interest as the eighth wonder of the world and it continues to a key strategy when taking a long-term approach to investing. This phenomenon refers to the returns that are generated from well-performing funds or shares which are then reinvested and result in a compounding effect on the investor’s overall returns.

If you were to invest $50,000 today and contribute $1,000 every month, over a 20-year period at an annual rate of return of 6% p.a., by 2041 you would have $601,784, with more than half of this amount ($311,784) being made up of compound interest. Therefore, starting early and reaping the benefits of compound interest is a financial tip that your future self will thank you for.

Minimising Fees

Fees and costs are an inevitable part of investing and irrespective of the platform, brokerage firm, adviser, or specific holdings you choose, fees are likely to always be incurred. However, fees can be minimised and unlike the market, is one of the variables that investors can control. This can significantly increase an investor’s returns over the long-term as the income and capital gains generated from well performing investments are not swallowed up, and instead go into your pocket.

Transaction fees can be minimised by taking a long-term approach to investing and not trying to time the market. Investors that consistently try to buy the bottom of the dip, and the sell at the top of the peak, not only risk missing out the gains associated with being invested over the long-term but also incur higher fees from constantly buying and selling their holdings. This means that even those investors who are lucky enough for this approach to pay off, the returns they generate may be reduced by the excessive brokerage and buy/sell costs they are required to pay. Platform and admin fees can also be reduced by shopping around and ensuring that the investment product, platform, and specific holdings are appropriate for you. This includes ensuring you are exposed to the right asset classes that align with your risk profile at a price that is proportionate to your portfolio.

Super and Retirement

Growing your wealth and setting yourself up for retirement starts with the conscious choices you make today. This does not necessarily have to involve extensive sacrifices, but instead understanding the contributions available to you that will enable you to maximise your super, and ensure you are comfortable in retirement. There are a range of tax-deductible super contributions that may be available to you such as concessional contributions which allow investors to allocate up to $27,500 p.a. This is taxed at 15% within the super environment, instead of at your marginal rate. To read more about how these contributions work and whether you could be eligible, please click here.

If you would like further guidance on any of the above financial tips or would like to take implement any of the strategies mentioned in this article, please click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser today.

This information is purely factual in nature. Please do not rely on this information to make any financial decisions as this information has not been tailored to your personal. circumstances. If you would like financial product advice or services please let me know and I will set up an appointment for you. Any advice in this email is of a general nature only and has not been tailored to your personal objectives, financial situation and needs. Before acting on this advice, you should consider whether it is appropriate having regards to your personal objectives, financial situation and needs. Before making a decision to acquire a financial product, you should obtain and read a Product Disclosure Statement (PDS) relating to that product, it is important for you to consider these matters and to seek appropriate advice. The material contained in this email is based on information received in good faith from third party sources, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Past performance is not a reliable guide to future returns. Licensee EPG Wealth Pty Ltd 529273 – associated employees or agents may have an interest in or receive monetary or other benefits from the financial products and services mentioned in this article.

<a href=’https://www.freepik.com/photos/woman-notebook’>Woman notebook photo created by karlyukav – www.freepik.com</a>