After years (or should we say, decades) of working, you would like to think of your (metaphoric &/or actual) blood, sweat and tears has finally paid off and you can now look forward to enjoying all that super you’ve built up to finally retire on. In this article, we’re talking all things super: we’ll discuss the importance of making extra super contributions before you retire, the types of super contributions and most importantly, what to do with your super once you’re able (and ready) to retire.

The importance of making extra or early super contributions.

Investment Trend’s regular Retirement Income Report showed that 44% of surveyed retirees said they should have made extra (or earlier) super contributions. Retire with #noregrets: super is one of the best ways to boost the amount of money you have when you’re able (or ready) to retire. More importantly, the sooner you start the greater the impact.

What is a super contribution?

A super contribution is money that is deposited into your super account. Your employer is obliged by law to put no less than 9.5% of your before-tax salary into your super under the Superannuation Guarantee Scheme. This money is held on your behalf by your super fund until you’re eligible to access it. However, you can voluntarily add more.

Despite the fact that many Australians need to make additional contributions to secure sufficient retirement savings, only 1 in 8 employed super fund members make additional contributions to their super.

Why should I make early or extra super contributions?

One of the most important reasons why you should make early or extra super contributions is the power of compound interest. Not convinced? Einstein famously labelled compound interest the eighth wonder of the world (and we couldn’t agree more). Simply, contributing an extra $500 a year, early in life (which is less than $10 a week) would see nearly a $100,000 boost in your retirement savings. Early super contributions may also have tax benefits. For example, according to the ATO (Australian Tax Office) salary-sacrificed contributions are not counted as assessable income for tax purposes – this means that the contributions are not subject to pay as you go (PAYG) tax.

Although, these contributions are still taxed within your super fund, but at a rate of 15%, which is lower than most people’s marginal tax rate. For example, those in Australia earning between $45,001 and $120,00 pay a marginal tax rate of 32.5% for each $1 over $45,000 (as well as an additional $5,092). Therefore, in the long run, it’s better that your hard-earned cash is being taxed at 15% not the 32.5% (or more) i.e. that means potentially more money in your hands (at retirement) than in the hands of the tax man. More or less, you’re saving more effectively for your future self.

What is a salary-sacrificed super contribution?

Very simply, a salary-sacrificed contribution is one where you elect to transfer money from your pre–tax wages into your super account.

Employer contributions (i.e. the compulsory 9.5%) and salary sacrificed contributions are referred to as concessional contributions, as they both happen pre-tax but then taxed in your super fund at 15%.

What is a personal deductible contribution (PDCs)?

These are voluntary contributions you can make using post–tax dollars (for example, if you were to transfer money from bank account into your super), then claim a tax deduction for these payments. These can be made by both the self-employed and employees.

What is a non-concessional super contribution?

A non-concessional contribution refers to money you put into your super fund using post-tax money and do not claim a tax deduction. People generally choose to make non-concessional contributions when they have reached their yearly concessional contribution cap (please see below) following an inheritance or unexpected windfall for example – or to receive a government co-contribution.

What are super contribution caps?

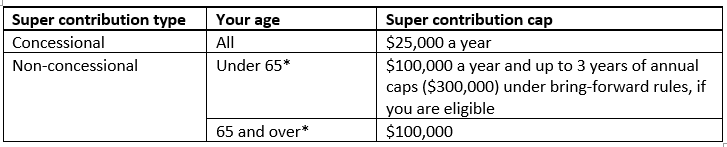

If you do choose to make additional contributions to your super (we’re obviously big fans), please keep in mind that there are limits on the amount you can contribute each year. There are separate caps for concessional and non-concessional contributions.

Here is how much super you can contribute each year :

This changes July 1 2021 concessional will change to $27,500 and non-concessional will change to $110K.

*your age is determined as at 1 July of the financial year in which the contribution is made. To read more about the bring-forward rules click here.

And the burning question:

How and when can I access my super?

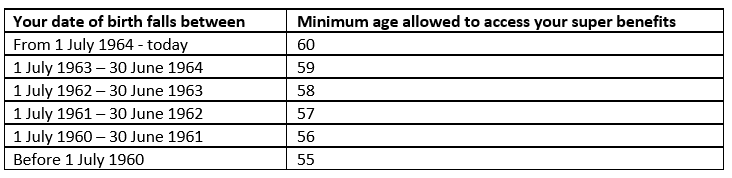

Generally, you can access your super when you reach preservation age, which will be between 55 and 60, depending when you were born (please see below). You will also need to be permanently retired from the workforce, this means you do not intend to work in paid employment for more than 10 hours a week -or- you turn 65, which is the age at which you have unrestricted access to your super.

What is my preservation age?

As for what you do with your super – which from age 60 is typically accessible tax-free (and why it’s so beneficial to make those voluntary contributions) – you will have a few options.

There are a few exceptions and other ways to withdraw your super before you’re 65 (i.e. the age in which you get unrestricted access to your super). For example, if you’re wanting to continue to work full-time, part-time or casually you could access a portion of your super balance via a transition to retirement pension (TTR).

What is a transition to retirement pension (TTR)?

If you’ve reached your preservation age and you’re still working, a transition to retirement pension may suit you. It can be used to reduce your working hours while maintaining your income or to reduce your tax, when used in conjunction with increased concessional contributions (remember concessional super contributions are those made pre-tax but taxed by your super fund at 15%).

The TRR pension is great if you’re looking to reduce your working hours but can’t afford the drop in income- a TRR pension can top up your reduced salary. The TRR pension income is tax-free for those aged 60 and over. If you’re 55-59 you may pay tax on the TRR income bit you will receive a tax offset equal to 15% of the taxable portion. But remember, accessing your super early, will reduce the amount you have left when you do fully retire. There is also a bit of complexity to the TRR, it’s best to reach out to a financial adviser to help you understand whether this strategy is right for you.

Alternatively, if you’ve reached preservation age and you want to hang up your boots completely and retire, you can choose to take your super as a lump sum i.e. withdraw all your super as cash, you can also leave your super where it is for a while or you could move it into an account-based pension or annuity if you want a regular income stream.

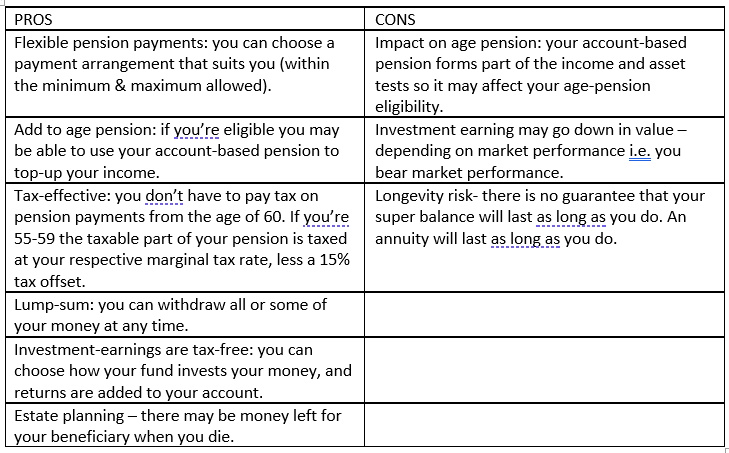

What is an account—based pension?

An account-based pension (which you may also be referred to as an allocated pension) is a regular income stream (i.e. you pay yourself an amount from your super at a set frequency) which you can use once you have reached preservation age (between 55 and 60). It works by rolling over your superannuation balance (also referred to as your accumulation account) into your new account-based pension account. It lasts as long as your super money does and is not a guaranteed income for life – hence the importance of building it up earlier in life.

What is an annuity?

An annuity (which may also be referred to as a lifetime or fixed-term pension) allows you to convert money – generally your super – into an income stream. It is a product that provides you with regular income over an agreed period of time in exchange for a lump sum payment. You can use your super (or savings) to buy an annuity from your super fund or life insurance company. Generally, you chose whether you want the payment to last for a fixed number of years, your life expectancy, or the rest of your life.

What’s the difference between an annuity and an account-based pension?

Share market performance will not affect annuity returns, which in turn makes an annuity one of the more stable income retiree investment options. If you chose an account-based pension, your money is invested in a range of investments, including shares, property, and bonds (and potentially NFTs and cryptocurrencies). This gives potential for better growth and investment performance (although if there’s a market crash, it may also mean the opposite). Therefore, the share market performance will affect your returns and makes an account-based pension riskier than an annuity.

So which income stream should you chose?

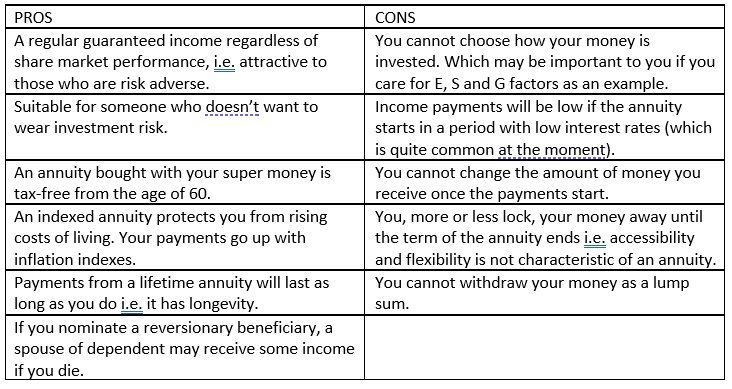

It’s best to weigh up the pros and cons of both, we’ve set up a table below which may help. It’s best to get financial advice from a licensed financial adviser if you need more information.

ANNUITY

What’s a reversionary beneficiary?

A revisionary beneficiary is the nominated person (which is commonly a spouse) who will automatically continue receiving he pension after your death.

ACCOUNT-BASED PENSION

Can I use both an account-based pension and annuity?

Yes, you can use a mix of retirement income options. You don’t have to take an all or nothing approach to your retirement income. You may for example benefit from a mix of options, such as an annuity, account-based pension, or lump sum. Everyone’s situation is different, and you need to consider your personal needs and circumstances before deciding which is best for you. Your super fund or a licensed financial adviser can help you assess and make the best strategy that’s right for you. If you would like to talk to an EPG Wealth financial adviser please click here.