You may be wondering what happens to your super when you die. Where the money goes will be contingent on who you nominate to receive your superannuation death benefit, called a beneficiary. To learn more about what happens to your superannuation and who you can nominate as a beneficiary and why it is important, continue reading.

What is a superannuation death benefit?

Deciding who will receive the money in your superannuation when you die is not usually an asset that is distributed according to your estate. This is due to the fact that your super is an asset held on trust for you, the beneficiary, which you become the legal owner of upon meeting particular conditions of release. In comparison, Wills typically determine where your personal assets will go such as property, cash, investments, jewellery and other personal items. To read more about estate planning, click here.

To decide who you would like your super to go to, you need to inform your superfund by electing a valid beneficiary. You may nominate the following individuals as beneficiaries:

- Your current spouse or partner

- Your children (any age)

- Someone who is in an interdependent relationship with you

- Anybody financially dependent on you when you die

- Your estate or personal legal representative.

What is an interdependent relationship?

A relationship of this kind exists in the following circumstances:

- Whereby two people have a close relationship

- They live together

- One or each of them provides the other with financial support and

- One or each of them provides the other with domestic support and personal care.

What is the difference between binding and non-binding nominations?

When you select a beneficiary to receive your superannuation this can be done as a binding or a non-binding nomination. A binding nomination means that the superfund must give your super to the chosen beneficiary in the event of your death, as long as has been validly made and in force.

A non-binding nomination provides the superfund with some discretion about who the super goes to. This type of nomination still informs the fund of where you would like the super to go, however, it is not legally binding. The result of this is that your super fund will take it into account, yet they remain legally responsible and will take into consideration relevant legislation when making this decision.

Why is it important to make a nomination?

It is important to make a nomination, as failing to do so will result in the superfund using their discretion to determine which dependent/s will receive the death benefit. Alternatively, the payment may be made to your legal personal representative who is responsible for administering your estate and therefore it will be distributed according to your will.

How will the benefit be paid?

How the benefit will be paid will be determined by the classification of the nominated beneficiary. If the beneficiary is a dependent, it can be paid as either a lump sum or over time as a regular income stream. Whereas, if your beneficiary is not a dependent of the deceased, it must be paid as a lump sum.

There are some restrictions around who can receive the death benefit as an income stream. This is only available to adult children under the age of 25 who are also financially dependent on the deceased or have a permanent disability.

What is the meaning of dependent?

If you are the nominated beneficiary of someone’s superannuation, it is important to understand the meaning of dependent. Different rules exist under superannuation law in comparison to taxation law and therefore it is important to understand how dependent is classified under each one.

The meaning of dependent under superannuation law for the purpose of death benefit payments includes:

- The spouse or de facto partner of the decease

- A child of the deceased (at any age)

- A person in an interdependency relationship

However, this differs from the meaning of dependent under taxation law for tax purposes. You will be considered a dependent if at the time of their death you were:

- Their spouse or de facto spouse

- A former spouse or de facto spouse

- A child of the ceased (below the age of 18 only)

- In an interdependency relationship with the deceased

- Any other person dependent on the ceased.

Therefore, children over the age of 18 although considered dependents under superannuation law will only be viewed as dependents for tax purposes if they were financially dependent on the deceased.

What will the beneficiary be taxed?

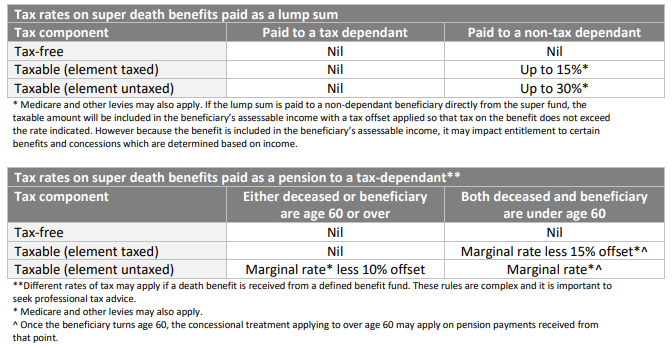

How the beneficiary of a deceased’s superannuation will be taxed will be contingent on:

- Whether they are a dependent of the deceased (under the taxation law meaning)

- Whether it is paid as a lump sum or income stream

- Whether the super is tax-free or taxable and whether the provider already paid tax on the taxable component

- The beneficiary’s age and the age of the deceased person when they died (for the purpose of income streams)

If you do not fall within the meaning of dependent under taxation laws, whereby you are the deceased’s child but exceed the age of 18, you are likely to pay a higher rate of tax and are only eligible to receive the death benefit as a lump sum.

The table below outlines the relevant tax implications of each category

Source: MLC

It is important that you enquire with your superfund about your binding or non-binding nomination/s as not all super funds offer their members the opportunity to make a binding death benefit nomination.

It is also a good idea to seek advice to ensure that any nominations made are validly completed as these nominations only become verified once you have passed away. If you would like some guidance concerning where your super will go when you die or are seeking advice about how your super is currently invested, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.