Whether you are a seasoned investor or new to investing, dollar-cost averaging is an important concept and practice that all investors should become acquainted with. This article will explain this concept and the ways it could benefit your current investment strategy as well as the potential risks that need to be considered.

What is it?

Dollar-cost averaging (DCA) is a process whereby investors choose to invest their capital in smaller, fixed amounts on a regular basis over a longer period of time instead of in one lump sum. As risk is measured in time, the key advantage of this strategy is that investors reduce the ‘timing risk’ of trying to pick the bottom of the market. For example, instead of investing $10,000 all at one time, following this approach would see the investor make $1,000 investments over 10 months.

When this is followed, although the price of the particular asset you are investing in may increase or decrease, the risk of paying a higher price is reduced whilst you maximise your chances of paying a lower average price. This enables investors to have more time in the market, rather than timing the market, which even for seasoned investors, is very difficult to always find and buy at the bottom of the dip. To read more about time in the market, click here.

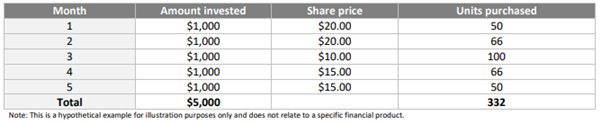

The following example outlines a dollar-cost averaged share investment whereby a fixed amount of $1,000 was invested in a share each month as the market price fell and then recovered.

Source: MLC

The above example shows that the total shares were purchased at an average cost of $15.01. If the shares had been purchased at the commencement of the five months at $20 a share, there would not have been any gain on the investment when the shares returned to their original value at the end of the five months.

What are the benefits of dollar-cost averaging?

This approach provides investment discipline to investors which in turn gives individuals more certainty around when to invest instead of trying to rely on when they think the market has plummeted or peaked. Another advantage of this strategy is that when markets fall, only part of your investment is exposed to this decrease and not the full amount that will be invested at the end of the period. In conjunction with this, during a downturn, the same amount of money will buy more shares or units for that month.

Dollar-cost averaging also provides structure to investors who may not have large lump sums available to them and therefore is a strategy that will enable individuals to set aside a small amount of their income each month to invest. Thus, ensuring investors can continue to fulfil their investment strategy whilst simultaneously meeting their other expenses or financial needs.

Dollar-cost averaging is a straightforward way for most investors to incrementally grow and build their wealth over time without constantly watching the market. To read more about the top financial tips for high-income earners to grow their wealth, click here. However, before implementing this approach it is also important to consider and understand the associated risks of DCA.

What are the risks to consider with dollar-cost averaging?

With any investment strategy associated with the stock market, there is risk attached. It is important to consider the result of dollar-cost averaging if the market is trending upwards. In this case, a lump sum would likely be a more fruitful investment compared to dollar-cost averaging. This is because an investor would receive a gain on the full investment amount instead of the smaller amount invested that month.

In conjunction with this, when there is a consistent market downturn, a portfolio that is invested with a dollar-cost averaging approach will still have to recover from the losses incurred as a result of falling market prices. However, taking this approach may reduce the losses overall in comparison to investing a lump sum.

Before making any decisions about your current investment strategy it is important to consider the benefits, risks and costs associated with any financial decision.

If you would like assistance with your current investment strategy or would like to start your investment journey, please click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.

<a href=’https://www.freepik.com/photos/thinking’>Thinking photo created by wayhomestudio – www.freepik.com</a>