A phenomenon that you may have seen in the news recently and are likely to hear more about is inflation. If you would like to know more about inflation and what it could mean for you and your financial position, keep reading below.

What is inflation?

Inflation can be understood as the ‘decline of purchasing power of a given currency over time.’ This is measured through the increase in the prices of the goods and services that households buy. The most commonly used indicator of this is the Consumer Price Index (CPI) which is a measure of the percentage change in the price of a basket of goods and services consumed by households in an economy over a period of time. What this means is that one unit of a particular currency buys less than it did in previous periods. This can also occur in the reverse which is called deflation. This is when the purchasing power of a currency increases, and prices decline.

What does this mean for individuals and the economy?

As inflation concerns the economy, it has an impact on many other economic forces such as unemployment, the labour market and the stock exchange.

Unemployment and labour market:

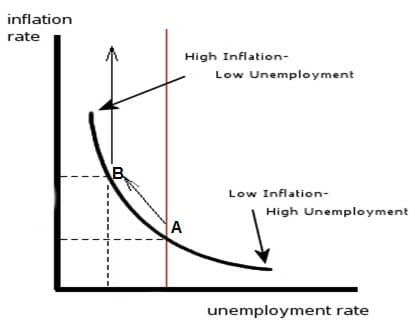

Traditionally, the relationship between inflation and unemployment has been an inverse correlation. When unemployment is high, the amount of people looking for work (labour supply) is greater than the demand for it. This has an impact on the wages that people earn as there is no pressure on employers to bid for workers through increasing wages as there is an excess of supply. Therefore, when unemployment is high wages do not change. The opposite occurs when the labour supply is low and the demand for employees is high. This leads to rising wage inflation as employers need to offer higher wages to attract workers to the roles they are offering.

This negative relationship between unemployment and wage inflation can be summarized through ‘The Phillips Curve.’ A.W. Phillips was one of the leading economists to provide evidence of this phenomenon. This relationship also affects the wider economy as an increase in wage inflation means that individuals and households have more money to spend on goods and services within the economy which also puts upward pressure on the overall rate of inflation.

Source: Google Images

Both of these forces are central tenets to how Central Banks devise and establish monetary policy. Australia is currently experiencing the lowest unemployment rate in 50 years of below 4 per cent. This was unimaginable only two years ago when the COVID 19 pandemic and subsequent lockdowns decimated the Australian and global economies.

The Reserve Bank of Australia is yet to increase interest rates in anticipation of higher inflation because of the low unemployment rate, which is an ‘unprecedented experiment’ in central banking. The main drivers of the strong labour market are the border closures which have locked out skilled workers and foreign students as well as the Federal Government’s $300 billion debt-funded stimulus initiatives.

Despite this, the forces of global inflation are likely to be felt in Australia through an increase in the prices of petrol, food and home building costs. As well as this, the RBA is set to increase interest rates in late 2022 or 2023.

Stock market:

With the global economy experiencing a strong recovery after the COVID 19 lows in March 2020, investors have enjoyed the associated returns over the last 24 months. However, rising inflation rates can have implications on the economy as it generates business and investor uncertainty and can place upward pressure on interest rates, but downward pressure on other asset prices.

Inflation can have an impact on investors as someone has to bear the brunt of higher prices whether it is suppliers or consumers. This is exacerbated if increasing prices are not reflected in an increase in wages. This can also cause a drop in consumer spending and business investment as the price of goods and services increase.

Inflation also impacts investors and the actual rate of return they receive on their investments. For example, if you invest in a term deposit that pays 4% p.a., and the inflation rate is 2% p.a., your actual rate of return is 2% p.a. Therefore, a higher rate of inflation means investors need a higher rate of return to break even and have a profitable investment.

In addition to this, many investors who wish to borrow are likely to find that an increase in inflation and subsequent interest rates will make borrowing more expensive. This has the potential to hinder the returns of investors as they need to receive additional returns to pay off more expensive debt.

If you would like assistance or guidance on your investment journey, please click the link to organise a complimentary 20-minute consultation with an EPG Wealth adviser.

This information is purely factual in nature. Please do not rely on this information to make any financial decisions as this information has not been tailored to your personal. circumstances. If you would like financial product advice or services please let me know and I will set up an appointment for you. Any advice in this email is of a general nature only and has not been tailored to your personal objectives, financial situation and needs. Before acting on this advice, you should consider whether it is appropriate having regards to your personal objectives, financial situation and needs. Before making a decision to acquire a financial product, you should obtain and read a Product Disclosure Statement (PDS) relating to that product, it is important for you to consider these matters and to seek appropriate advice. The material contained in this email is based on information received in good faith from third party sources, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Past performance is not a reliable guide to future returns. Licensee EPG Wealth Pty Ltd 529273 – associated employees or agents may have an interest in or receive monetary or other benefits from the financial products and services mentioned in this email.