Have you ever heard the term ‘sustainable investing’ and wondered what it means or how to practice ‘sustainable investing’?

Well, the answer is not as complicated as you may think. Sustainable investing refers to when an investor assesses a company based on their Environmental, Social and Governance (ESG) practices to select their investments. In doing so, capital used for investing can be used to promote Corporate Social Responsibility (CSR) and positive social and environmental change within businesses.

Examples of Sustainable Investing

Unfortunately, there is not one blanket approach when it comes to making sustainable investments. Different investors may find themselves understanding and defining the term ‘sustainable’ differently from one another. Some common examples of sustainable investing strategies include:

1. Impact investing: This involves investing in companies or projects with the intention that have a specific positive social or environmental impact in addition to generating financial return. For example, an investor may choose to invest in a company that produces windmills to promote the use of renewable energy.

- Performance of impact investing

GIIN conducted an Annual Impact Investor Survey in 2020 to assess the performance of impact investing. Results showed that of the 282 investors surveyed, 88% of respondents stated that impact investing generated financial returns that were in line or outperforming their expectations. Similarly, of the 274 investors surveyed, 99% responded stated that their impact expectations were either met or over-achieved.

2. Socially responsible investing (SRI): This category of sustainable investing involves avoiding companies that are involved in controversial activities, such as tobacco or weaponry production. It also can include investing in companies that have positive social or environmental policies.

- Performance of socially responsible investing

Data from Morningstar, addressed in their article ESG Investing Keeps Pace With Conventional Investing in 2022 observed that sustainable investments and the overall market created similar yields in 2022. “The broad Morningstar US Sustainability Index fell 18.9% in 2022, outperforming the 19.5% decline of its parent, the Morningstar US Large-Mid Cap Index.” Over the same time period, the S&P 500 dropped by 19.4%.

3. Environmental, social and governance (ESG) investing: This involves considering a company’s overall performance on environmental, social and governance issues when making investment decisions. This can include companies that have a good track record on reducing their carbon footprint, treating employees well, and having strong governance practices.

- Performance of environmental, social and governance investing

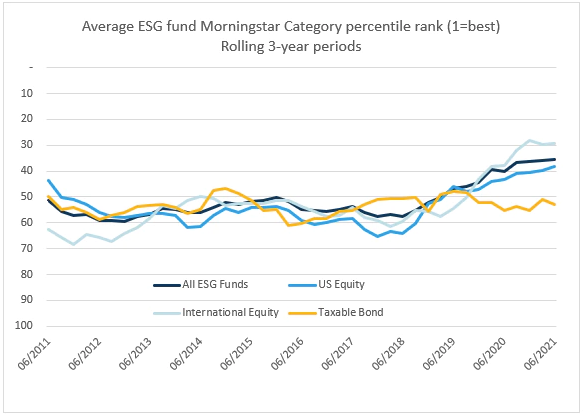

Research conducted by Charles Schwab Investment Advisory, suggests that ESG funds have consistently ranked average in comparison to their peer groups when looking at financial outcomes.

Source: Charles Schwab Investment Advisory, Morningstar Direct as of 6/30/2021.

4. Green bond investing: Green bonds refer to bonds that are used to fund businesses and projects that offer social and environmental benefits. Investing in green bonds involves investing in bonds issued by companies or governments for environmental projects, such as renewable energy or sustainable transportation. Victoria was the first Government within Australia to begin issuing Green Bonds, with money used to fund investments with 78% dedicated for transport and 14% for renewable energy.

5. Positive screening: This involves investors prioritising companies that make beneficial contributions either socially or environmentally. An example of positive screening can be when investors choose stocks relating to renewable energy, technology and/or healthcare. According to a study by Deutsche Asset & Wealth Management and Hamburg University in 2015, it was found that there was a 90% positive correlation between ESG and corporate financial performance over 2000 empirical studies on ESG performance. This means to a high extent, as a company’s ESG increases so does their financial performance.

6. Negative screening: Conversely to positive screening, negative screening involves investors avoiding companies that cause harm to the environment or social harmony. For many investors, the practice of negative screening requires the rejection of stocks ranked in the bottom 20% based on their ESG score. An example of negative screening can be when investors avoid stocks relating to fossil fuel, tobacco and/or weapons. However, a key point to note relating to the effect of negative screening on the performance of your portfolio is well summarized by Jon Hale, head of Sustainability research at Morningstar. Stating “academic research has shown that stock exclusion trends tend to be a negative factor in performance.”

In summary, Sustainable Investing has evolved and changed the investing landscape for the future and is one approach you may consider when looking at making your next investment.

If you would like to improve your current investment strategies or are looking to start your investment journey, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.