Non-concessional contributions (NCC) refer to contributions made to your super fund from your after-tax income. These contributions are not taxed in your super fund.

There is a cap placed on an individual’s NCC. From 1 July 2021 the cap has increased as a result of indexation from $100,000 to $110,000.

The Bring Forward Rule, other wise known as bring forward arrangements, allows you to gain access to future year’s caps, if you meet certain criteria. This allows individuals to boost their retirement savings in a shorter period of time and be able to take advantage of potential tax benefits.

Are you eligible?

To be eligible for the non-concessional contributions (NCC) bring forward rule, there are four key considerations, which will be discussed in detail below.

1. Age

As per current legislation implemented on 1 July 2022, an individual must be under the age of 75 years to trigger the bring forward rule prior to 1 July of that financial year. The ATO further specifies that an individual’s final NCC contribution must be made before the 28th day of the month directly after their 75th birthday.

2. Total Super Balance

An individual’s Total Super Balance (TSB) is their total super balance prior to 30 June. It is inclusive of all super funds under an individual’s name and can be utilised to define the total NCCs that they can make.

| TSB on 30 June of prior financial year | Bring-forward period NCC available |

| Less than $1.48m | 3 years ($330,000) |

| $1.48m to < $1.59m | 2 years ($220,000) |

| $1.59m to < $1.7m | 1 year ($110,000) – no bring forward available |

| $1.7m and above | Nil |

3. Top up contributions

In the second or third year within a bring forward period, an individual’s total super balance bust be below their general transfer balance cap before 30 June of the financial year to make additional NCCs. The general transfer balance cap is set at $1.7 million from 1 July 2022, but forecasted to increase to $1.9 million in 2023 subject to the approval of the Government. To understand more about these changes, click here.

4. Management of the NCC

To access information about your NCC, you can log into your MyGov account, where you will be able to download a report of your personal non-concessional contributions and total super balance. When getting financial advice, this report can be beneficial in reflecting your current financial position.

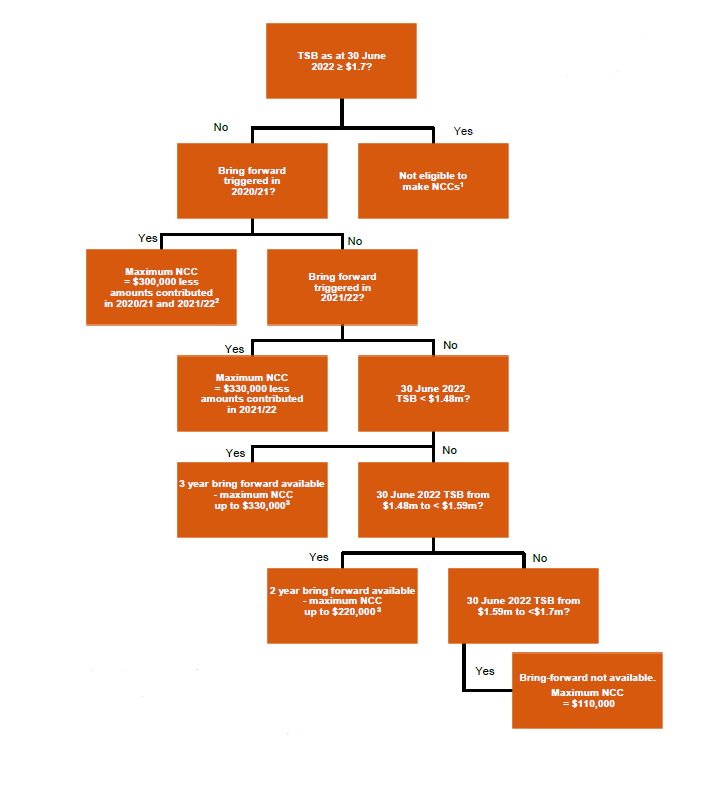

To understand if you personally qualify for the bring forward rule, you can use the following flow chart. Please note that the flow chart assumes at all contributions are made before the 28th day of the month directly after an your 75th birthday, and that you are aged under the age of 75 years prior to 1 July.

Figure 1: Determining 2022/23 NCC and bring forward eligibility.

Source: MLC Technical Fast Facts 2022

Its important to understand that the bring forward rule is just one of the many strategies that can be used to boost your personal retirement savings. Other strategies to consider include salary sacrificing and spouse contributions.

Ultimately however, the key way to growing your retirement funds is to make regular contributions and start early. Taking advantage of tax benefits that you are eligible for can help ensure that you are correctly set up and prepared for your retirement.

Superannuation is a long-term investment and harnesses the benefits of compounding returns means that small contributions along the way can have an exponential effect in the future.

If you would like to improve your current investment strategies or are looking to start your investment journey, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.