As the end of the financial year approaches you may be wondering if there are any superannuation contributions you can make to help boost your super balance and set you up for retirement. Australian superannuation is the fourth largest asset pool in the world and in 2017 it had an estimated value of $2.6 trillion and therefore, is an indispensable asset to have during your retirement. The following article will provide you with some tips to prepare you for the new financial year as well as the different types of contributions you can make and their associated benefits.

What are super contributions?

A super contribution involves the payment of money into your super account which is most commonly made by your employer called a superannuation guarantee (SG). Under Commonwealth law all employers are required to contribute 9.5% of an employee’s ordinary time earnings into their super account. These earning include commissions, annual leave loading, allowances and bonuses. This percentage is set to increase to 10% from July 1 2021.

Are you eligible to make contributions?

In order to be eligible to make super contributions you must:

- Be less than 67 years old,

- If you are aged 67 to 74, you must pass the work test or be eligible for the work test exemption and,

- Provide a notice of intent to claim to your superfund which is then validated.

Why contribute to your superannuation?

The purpose of your super is to provide you with an income stream in retirement in conjunction to any benefits you may receive such as the Age pension. Making contributions in addition to the SG you receive will accumulate over time and can often be a tax effective way to save your money. This can occur in a variety of ways, and includes the following:

Concessional contributions:

These are pre-tax contributions made into your super account in which there are three types:

- Compulsory contributions made by your employer (SG) as previously mentioned

- Salary sacrifice contributions which involves a portion of your before tax income being contributed to your super account by your employer instead of receiving it in your pay.

- Personal deductible contributions are voluntary contributions using after-tax funds which you can claim a tax deduction on. The advantage of these is that they are taxed at 15% if you earn less than $250,000 instead of your marginal tax rate.

- These are currently capped at $25,000, which is set to increase to $27,500 from July 1 2021.

- Catch up contributions which enable you to use unused concessional caps of previous years in the current financial year.

Non-concessional contributions:

This form of contribution involves depositing after-tax funds into your super account which you do not claim a tax deduction on. The advantage of this is that when you withdraw the money from your super account upon meeting the relevant requirements, it is tax free income. These contributions are currently capped at $100,000 but are set to increase to $110,000 from July 1 2021.

Bring-forward rule:

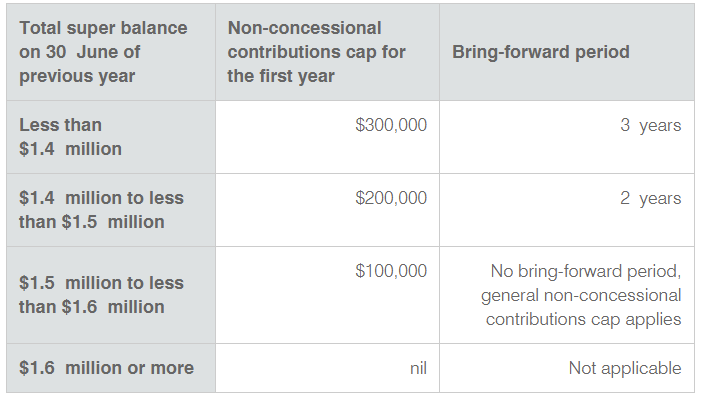

Source: Australian Tax Office

The bring-forward rule enables individuals younger than 65 to ‘bring-forward’ up to two years of unused non-concessional contributions to the current year. If eligible, you may be able to contribute up to $300,000 over a three-year period. This option is only available to those with a super balance of less than $1.6 million. The following table outlines the bring forward periods as provided by the ATO:

Down-sizer rule:

This rule enables those who are selling their principal place of residence to allocate up to $300,000 of the sale price to their superannuation, which does not count towards your non-concessional contributions. You must be 65 or over and have owned your home for 10 years or more before it is sold which is calculated based on the settlement date. A distinguishing factor of this form of contribution is that there is no requirement to meet the work test, however this contribution can only be made once. The $1.6 million cap which applies to other contributions is also not applicable for the down-sizer rule. For further information about this rule, click here.

Catch-up contributions:

From 2019-2020 onwards, this rule enables Australians to make additional concessional contributions to their super by accessing unused concessional cap amounts from previous years. In order to use these amounts your super balance must be less than $500,000 and you must have made concessional contributions in the financial year that exceeded your concessional contributions cap. The amount that can be carried forward will be contingent on what you have contributed in previous years and allows you to use caps from up to five previous financial years. However, these will expire after this time. To read more about catch up contributions, click here.

Co-contributions:

Super co-contributions are also available to low or middle-income earners who make personal post-tax contributions to their super in which the government may also make contributions to your superfund. This is to a maximum value of $500 and there are eligibility requirements in place. What you receive from the Government will be contingent on your income and how much you are personally contributing. The ATO determines which individuals are eligible for co-contributions based on their tax returns each financial year, in which the funds are deposited automatically. The eligibility requirements are as follows:

- You must have made one or more personal super contributions to your account in the last financial year,

- Pass the two relevant income tests,

- Be younger than 71 years old,

- Your total super balance must be less than the general transfer balance cap which is currently $1.6 million and will increase to $1.7 million from July 1 2021,

- Your contributions cannot have exceeded the non-concessional cap.

To learn more about this criteria and the relevant income tests, click here.

Contribution splitting:

This involves splitting a portion of your super contributions and rolling them over to your spouse’s super account. To determine whether this contribution is available to you, you must contact your super fund to ascertain whether they offer contribution splitting, the process to active these contributions and any additional fees which may be incurred. If you wish to claim a deduction on these contributions, you must also submit an intent to claim to your respective super fund. It should also be noted that splitting does not count towards your concessional contributions cap. To learn more about the eligibility requirements, click here.

Spouse contributions:

If you are in a spousal relationship, there are also ways to contribute to your partner’s super if they are taking time off work to care for your children or earning a lower income. These contributions can be made from after tax income which also enables you to claim an 18% tax offset on up to $3,000 when you lodge your tax return. To be eligible you must be married or in a de facto relationship and both be Australian residents. Your spouse must be either under the age of 67, or if they are aged between 67 and 74, they must meet the work test requirements, which you can read more about here. Your spouse’s income must also be $37,000 or less to receive the full tax offset, or alternatively less than $40,000 to receive a partial tax offset.

Once you turn 60, you are able to access your superannuation which is income free of tax. Your super can also be invested in certain assets which may not be ordinarily available to you. Therefore, contributing to your superannuation is a highly tax-effective way to set yourself up for a stress-free and enjoyable retirement. If you would like to speak to an EPG Wealth adviser to discuss which contributions are available to you and the ways you can maximise your super, click here.