Life insurance refers to a range of insurance types available to Australians which can help to protect them if unexpected life events that occur. The following article will outline both the different types of policies available as well as the impact of financial advisers charging commissions on insurance policies they recommend, and how you could be better off.

What is life insurance?

Life cover is paid out where the policyholder dies or has a terminal illness and helps to protect and support any loved ones by reducing their financial burden. This form of insurance will pay out a lump sum if you pass away and the money is paid to the nominated beneficiaries. If there are no beneficiaries, your estate or super trustee will determine where the money will be allocated. Individuals usually take out a life insurance policy when they start a family or have taken on debt.

Total and Permanent Disability (TPD) assists policyholders by providing financial support through a lump sum payment if they become permanently disabled and can’t work again. This can help to pay for rehabilitation expenses, ongoing medical costs, and the increased cost of living with an ongoing illness. It is important that individuals are aware of the various definitions of ‘totally and permanently disabled’ as this may change from insurer to insurer. You can find this out by reading the policy’s product disclosure statement.

Trauma or critical illness will pay policyholders a lump sum payment if they suffer a critical illness or serious injury, including malignant cancers. This can help subsidise any medical costs, living expenses, nursing care or changes to housing if required.

Income protection provides policyholders with a monthly payment if they are unable to work as a result of an illness or injury. This can pay individuals up to 90% of their pre-tax income in the first six months and up to 70% for a specified time after six months. It is also important for policyholders to conduct adequate research prior to taking out an income protection policy as insurers use different definitions of partial or total disability that must be satisfied before claiming on the policy. To find these, read the policy’s product disclosure statement.

How can I reduce the cost of my insurance premiums?

Although insurance is an important part of securing your financial stability and provides you with peace of mind that you will be supported if an unexpected life event occurs, it can be costly and place additional pressure on your cost of living. There are a number of ways that individuals can reduce these premiums which are outlined below.

Adviser commissions on insurance

A financial adviser can be a critical asset for individuals as they can help to ensure you are receiving an appropriate and adequate level of cover at a cost-effective price. However, many financial advisers receive commissions from the policies they recommend which may result in you taking out additional cover you may not require. The recent Quality of Advice Review into the financial advice industry found that the industry is heavily reliant on the commissions received from insurance, with 94% of advisers accepting life insurance commissions.

EPG Wealth is among the 6% of Australian advisers that do not charge commissions on the insurance they recommend. This has a drastic impact on the cost of taking out life insurance and can lead to tangible savings in the pockets of policyholders instead of advisers and is demonstrated below.

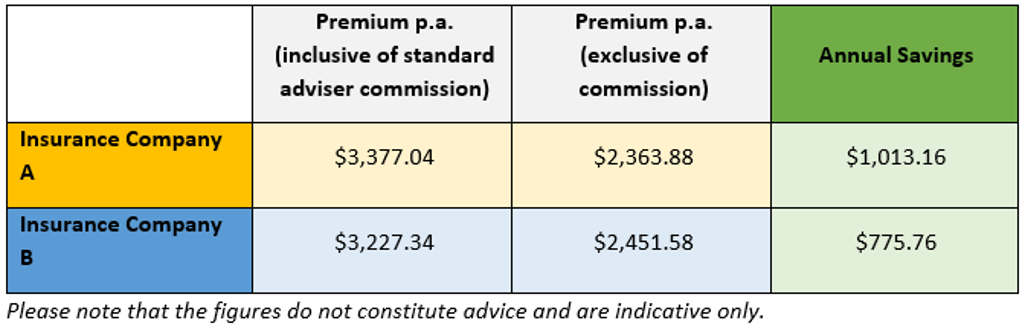

The figures below assume that client A is a 33-year-old male (non-smoker), earning approximately $220,000 p.a. and requires $1,000,000 cover of life, total permanent disability, and $13,750 per month of income protection. If this client were to hold a policy from insurance company A for a period of 10 years, they would end up paying an additional $10,131 in premiums.

Client A:

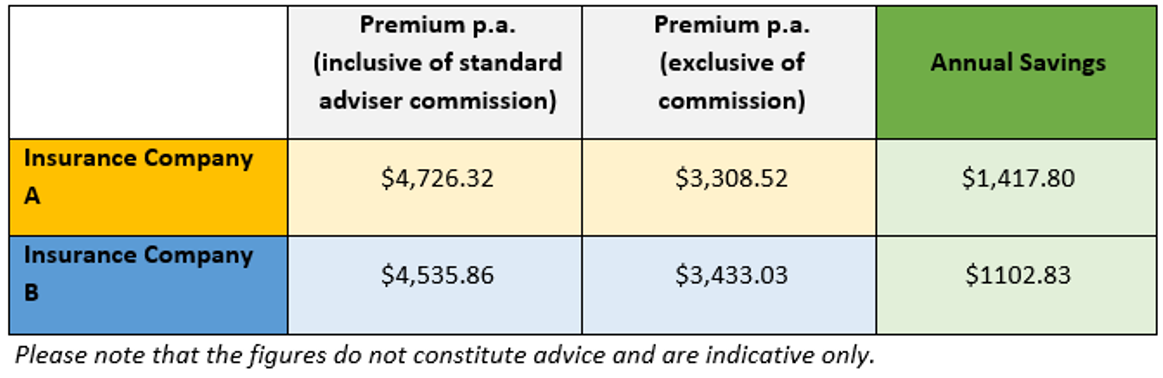

Similarly, below is the cost of insurance premiums assuming the client is a 40-year-old female (non-smoker), earning approximately $200,000 p.a. and requires $1,500,000 cover of life, total permanent disability and $12,500 per month of income protection.

Client B:

If client B were to hold a policy with insurance company A for a period of 10 years, they would end up paying an additional $14,178 in premiums. Therefore, these comparisons show that there are substantial savings when advisers do not take commissions on the insurance policies they recommend and hence this should be a primary consideration when engaging with an adviser. Therefore, although no implementation fee may be more appealing at the outset, this is likely to be an insignificant amount in comparison to the additional fees and premiums you will pay due to these commissions.

Other ways to reduce the cost of your insurance premiums include reconsidering how much life insurance you really need, shopping around for the right insurer as well as increasing the waiting period where possible.

If you would like tailored, transparent commission-free financial advice regarding your insurance, super or current investment strategy, please click here to organise a complimentary 20-minute meeting with an EPG Wealth adviser.