Purchasing a property does not only include the cost on the price tag, so is buying a property really the best investment?

Buying a property is associated with far greater costs than most Australians initially think. This includes the cost of the property as well as legal, mortgage and loan fees, plus council and utility rates. Below is an outline of the costs you can expect to incur when purchasing a property.

When it comes to buying a property, it is important to do your research. Most investors will dedicate countless hours to conducting research on the potential location of the property, as well as the deposit required and the maximum amount that can be borrowed. Therefore, it is crucial to figure out your motive for buying a property. This includes whether it will be an owner occupied or an investment purchase, as they differ in relation to the strategies required and have varying financial outcomes as a result.

When it comes time to consider purchasing, it is important to compare this with the other alternatives available to you. Scenario modelling is an effective tool which will assist with this process as it will help you to weigh up your options. Essentially, this involves looking at the different choices which are being considered and modelling them overtime to take into account the different variables. These include stamp duty, interest costs, insurances and maintenance costs, which will be discussed below.

Property Value:

The median national property price has been estimated to be $549, 918, with Sydney ranking as the city with the highest median property price at $872, 934. This is the first cost you’re going to be hit with and there are many more to come. It has been projected that with an average rise in house prices of 8.6% per annum, the national median house value could reach nearly 3 million dollars by 2043.

Stamp Duty:

The next big expense associated with purchasing a property is stamp duty. This is the tax levied by the government on certain transactions such as buying a house. Each State and Territory have their own respective approaches to calculating stamp duty, which considers a number of factors including the location of the property and whether the purchaser is eligible for any concessions or exemptions. This amount must be paid within three months of signing a contract for sale and does not include off-the-plan purchasing arrangements.

A First Home Buyers Assistance Scheme exists in NSW which provides those purchasing their first property, valued at less than $800,000 with the potential to receive a full or partial exemption from paying stamp duty. This group of buyers may be eligible for a grant of $10,000. In order to receive this, you must be buying or building your first home, the home must not be lived in and the property including land must be valued at less than $750,000.

Building and Pest Inspections:

There are also costs associated with checking whether the prospective property has any problems. This includes checking for pests and other damage which is particularly important for older homes. These inspections are expected to cost around $600.

Mortgage and transfer fees:

Another expense incurred when purchasing property is the cost of registering your mortgage and the legal ownership of your home. This is a crucial step as it transfers legal title from the previous occupier to you. In NSW both the transfer and mortgage registration fees are $146.40. Once you have paid off your mortgage you will also be required to pay an additional $146.40 as the mortgage has been discharged.

Discover tips to de-stress your mortgage here.

Conveyancing and Legal Fees:

When purchasing a property it is important to engage with a conveyancer or solicitor who will oversee the legal process of transferring the ownership of the property from the seller to the buyer. A professional conveyancer will also check the title of the property which could include any easements, covenants or caveats that may be in existence. This will help to ensure the transfer process is seamless and efficient.

Loan Application Fee:

Another expense incurred when purchasing a property is a loan application fee. If you are borrowing finance to fund the purchase of your home, you will need to pay to borrow the money as well as pay back the loan and any interest. These are estimated to be approximately $500-$600 but can exceed $1000 depending on the size of the loan and lending facility.

Mortgage Insurance:

Not only do home buyers have to register the mortgage but they must also obtain mortgage insurance, which is required in order to secure the property. Without a deposit of more than 20%, you will need to pay this fee which is calculated on a sliding scale. Although this is an additional expense, it provides an opportunity for buyers with as little as 5% of the purchase price to buy a property.

In addition to these costs which are incurred upon the purchase of your property, there are also many ongoing costs. This includes the interest which must be paid on your home loan, council and utility rates, insurances and property maintenance fees.

Ongoing Interest Rates:

When you take out a loan to fund the purchase of your property, your lending facility will also require you to pay interest which is the annual cost of borrowing the principal amount. This amount may be impacted by a number of factors including:

- The nature of the property (owner occupied vs investment)

- The interest rate type (fixed or variable)

- The loan repayment type (principal and interest vs interest only)

- The principal amount which is being borrowed

To discuss potential options such as establishing an offset account, you can speak to an EPG Wealth adviser here.

Council and Utility Rates:

There are also fees that must be paid for the council or water rates, which are shared between the buyer and seller based on the settlement date. These will be incurred once the purchase is completed and are ongoing for the duration of time that the property is occupied.

Insurances:

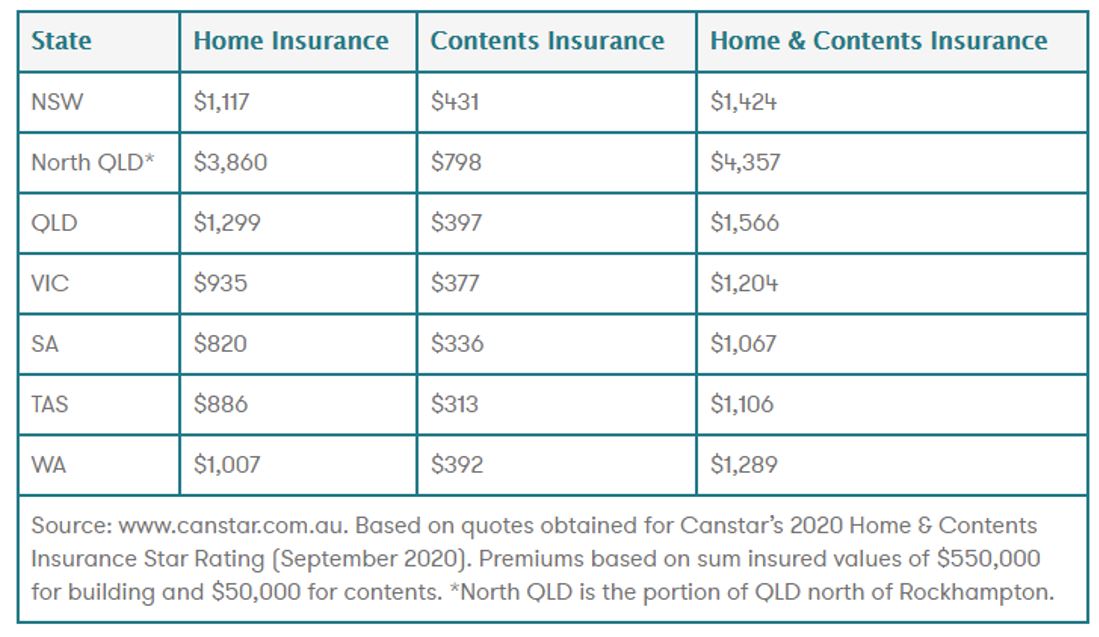

Home and contents insurance is a form of cover which provides financial protection by replacing or repairing your home and/or belongings in the event they are damaged or destroyed. This may include unforeseen events such as fires, storms, floods and theft. This may be in the form of ‘sum-insured cover’ or ‘total replacement cover.’ Below is a summary of the average cost of home and contents insurance in Australia.

Property Maintenance:

Another ongoing cost which must be considered is the cost of maintaining your property. Research has suggested the average cost of maintaining your home is approximately 1% p.a. of the total property value. Therefore, if your property cost $800,000 to purchase, it will cost approximately $8,000 to maintain every year. Alternatively, if you are renting out your investment property, the average property maintenance fees are around 5%-14% of all rental income, depending on where the property is located. These fees will affect the ROI of your property and thus value for money is crucial.

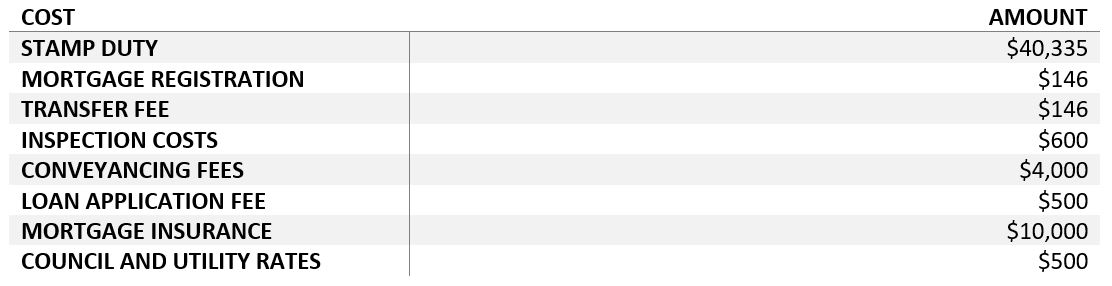

Below are the estimated costs based on the purchase of a $1,000,000 property in NSW, not including ongoing costs:

From this, we can see that total costs amount to $56,277.

If you are thinking of investing in property instead, you can find out more here.