Carry-forward or catch-up contributions are a form of personal concessional contribution that can be used to boost your super balance in a tax-effective way. The following article will discuss the advantages and risks associated with these contributions and how they may benefit you.

What does carry forward mean?

The catch-up rules allow individuals to make additional concessional contributions that exceed the general concessional caps without incurring additional tax. These rules enable you to access your unused concessional caps from previous years whereby those concessional contributions did not meet the cap.

Prior to the amendment of the Treasury Laws Amendment (Fair and Sustainable Superannuation) Act 2016, if individuals did not fully utilise their concessional contributions each financial year they were not able to carry forward the unused cap.

Is this rule available to me?

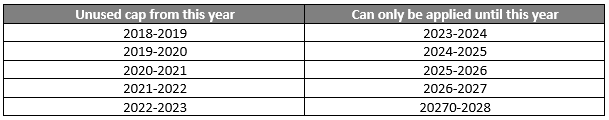

In order to utilise this rule, your total super balance at the end of 30 June of the previous financial year must be less than $500,000. It is also important to note that you can only carry forward unused concessional cap contributions from 1 July 2018 and they will expire after five years.

The table below provides the last financial year in which an unused cap can be utilised.

How could it benefit me?

The catch-up rules assist those individuals who may have had interrupted income or have not been in the financial position to make consistent contributions to their super. If you have taken time off work or have had other financial commitments which have prevented you from reaching your concessional contributions cap in previous years, the carry forward rule will allow you to make up for lost time and continue boosting your super balance.

If you are planning for retirement and are wanting to maximise your super balance before you cease working, utilising your unused caps can allow you to continue building your savings for retirement in a tax-effective environment. To read more about what super contributions may be available to you, click here.

It is also important to be aware of the tax benefits of these contributions. As these are voluntary contributions generally using post-tax funds, you are able to claim a tax deduction on the contributions made under the catch-up rules. The advantage of this is that they are taxed at 15% if you earn less than $250,000 instead of your marginal tax rate.

This provides a significant advantage to those wishing to build their retirement savings as the contribution amount can be claimed by you as a personal tax deduction against your assessable income in the relevant financial year, not including the 15% tax paid within your super fund. Therefore, allowing you to reduce the tax you must pay each financial year whilst simultaneously accumulating wealth and bolstering your retirement savings. If you have up to five years of unsued caps you may stagger your personal deductible contributions under the catch-up rules for as long as possible to continue contributing above the normal cap of $27,500.

What if I’m between the ages of 67-74?

However, if you are over 67 and still working and wish to continue making voluntary super contributions, different rules apply. In order to use the catch-up arrangements, you must satisfy either the work test or meet the work test exemption.

The work test:

The work test requires those over the age of 67 to be in paid work for a minimum of 40 hours over a consecutive 30-day period during a financial year. If you meet this test, you will be eligible to make voluntary super contributions including using the catch-up rules.

The work test exemption:

The work test exemption enables those who are aged between 67 and 74 with a super balance below $300,000 on June 30 of the previous financial year to make voluntary contributions for the 12 months, starting from when they last met the work test. To do this, these individuals must meet all of the following conditions:

- Satisfy the work test in a previous financial year,

- Total super balance (across any super fund) cannot exceed $300,000 as of June 30 of the previous financial year and

- Haven’t previously made contributions to super using the work exemption test.

If you satisfy these conditions you need to make a declaration with the super fund to show that you are eligible to make voluntary contributions under the work test or the work test exemption. Once these requirements have been satisfied with your super fund you can use the catch-up contribution rules to boost your super balance.

What should I consider before utilising this rule?

It is also important that you are aware of and familiar with the total amount of concessional contributions that have been made to your super for the financial years you are intending on using. This includes the super guarantee paid by your employer, any salary sacrifice contributions as well as concessional contributions you may have already made.

If you are not aware of the amounts which have already been made into your super and exceed the contribution caps, additional tax and penalties may apply.

Before making any decisions about your superannuation it is important to consider the benefits, risks and costs associated with any financial decision.

If you would like assistance to maximise your savings leading up to retirement or would like to start making additional contributions to your super, please click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser.