For many young people, superannuation is unlikely to be a consideration at the forefront of their minds, however, there are many unrivalled benefits of contributing to and maximizing your super from a young age. The following article will outline these benefits and how you can take advantage of them to boost your super account balance.

What is super?

Superannuation refers to the money you put aside which you can access once you retire from working. It is predominantly comprised of contributions you and your employer make which in most cases is invested in the stock market and accumulate over time. To read more about how super works and the different kinds, click here.

Why should you start early?

Compound Interest

A fundamental benefit of boosting your super balance from an early age is compound interest, which Albert Einstein once referred to as the ‘eighth wonder of the world.’ Compound interest refers to the returns generated from well-performing investments being reinvested and compounding an investor’s returns overall. Therefore, enabling your money to grow at a faster rate than if you left your money in cash outside of your super.

To explain how compound interest works, if you were to start with $10,000 in your super account, earning 10% interest annually, after 10 years your initial investment will have reached $25,927. This is more than double your initial investment just from the effect of compounding interest. This amount doesn’t consider the superannuation guarantee you would be receiving throughout this time which would also compound and further boost your super. If you were to contribute an additional $500 a year until retirement, which is only $9.60 per week, you would see almost a $100,000 increase in your retirement savings. Therefore, it is clear that the power of compound interest is unmatched and that boosting your super savings early will help you exponentially when it comes to retirement.

Co-contributions

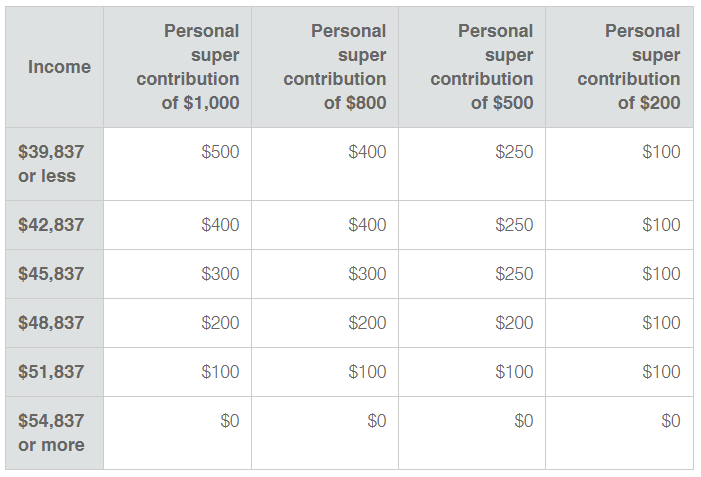

Another advantage for young people wishing to maximise their super savings for retirement is the Government’s super co-contribution scheme. Low- or middle-income earners that make a contribution of $1,000 a year are eligible to receive a $500 co-contribution from the ATO. The table below outlines the co-contribution amounts available for those who earn less than $54,837 for the 2020-21 income year. To read more about this scheme, please click here.

Tax

Another incentive for young people is the tax benefits associated with super. Unlike money such as your income outside of super, which is taxed at your marginal rate, the money inside your super is capped at 15%. This means that less of your money is being swallowed by tax, and more will end up in your pocket when you retire. It is also possible to make concessional contributions of up to $27,500 (after-tax) each financial year that you can claim a tax deduction on. To read more about the other contributions that you can make, click here.

Now that you understand the benefits of boosting your super from a young age, it is also important to know some key information about your super account.

Access

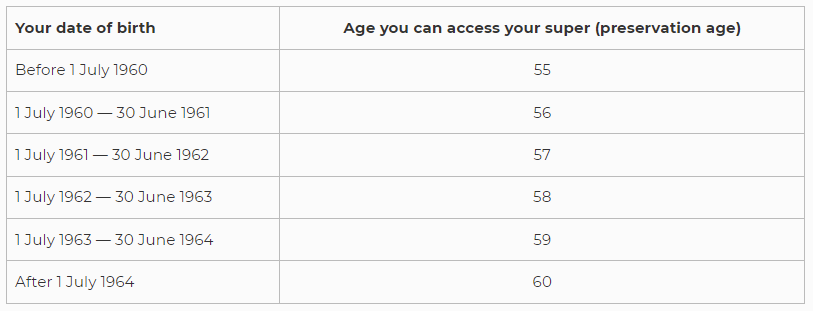

The first is that you cannot access this money until you retire and reach your ‘preservation age’ which is currently between age 55 and 60, depending on when you were born. The table below outlines these ages. If you are just beginning your working life this could be another 40 to 50 years away and therefore it is important to have sufficient cash outside your super for your living expenses and any unexpected emergencies that may arise. This is unless you are able to access your super early due to incapacity, severe financial hardship or other compassionate grounds.

It is also important to ensure that you are in the right super fund for you. If you had casual jobs as a teenager or young adult, you may have started a new super account every time you started a new job. If this is the case, it is a good idea to consolidate your super accounts to ensure that you are not paying excessive fees which could end up reducing your balance over time. To read more about the different types of super accounts available, click here.

If you would like assistance to structure your super in the most beneficial way for you, please click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser today.