Whether you are just starting out investing or have been growing your nest egg for a few years, it is important to be well acquainted with the fundamental principles around investing. One of these is the benefits of regular investing and the advantages of implementing a regular investment plan. If you would like to know more about how you can strategically boost your current investment portfolio, continue reading.

What are your goals and objectives?

Irrespective of what stage in your investing journey you are at it is critical that all investors have a clear idea of their short-, medium- and long-term goals. This is especially pertinent if you are just starting out and investing is an intimidating concept. Defining your goals and understanding the timeframes of each will allow you to ascertain how and when you will achieve them.

It is also important to know whether the money required to achieve your short-term goals can be invested or should remain in cash. The reason for this being that if the money you require in the short term is invested and liquidated when markets drop, there may be potential for you to realise a loss. Hence, reinforcing the importance of clearly establishing goals that are specific, measurable, achievable, realistic and time-bound.

What are the advantages of regularly investing?

Once you understand your goals and financial objectives, which may include a house deposit, saving for a wedding or holiday or saving for your retirement, you can now implement an investing approach that enables you to achieve these goals.

The first advantage of regularly investing is that you can ‘set and forget.’ This means setting up an automatic investment on a brokerage or investment platform which regular deposits money into your current holdings. This is particularly attractive for those individuals who do not have the time or discipline to manage a complex investment portfolio but still want to generate returns. The other upside to this is that it is likely to reduce risky investment behaviour and trying to time the market.

Another benefit of regular investing is the notion of dollar-cost averaging. Dollar-cost averaging refers to the process of investing in smaller, fixed amounts regularly over a longer period of time instead of in one lump sum.

As risk is measured in time, the key advantage of this strategy is that investors reduce the ‘timing risk’ of trying to pick the bottom of the market. For example, instead of investing $10,000 all at one time, following this approach would see the investor make $1,000 investments over 10 months.

This approach allows for greater discipline and certainty as it provides investors with more structure instead of trying to rely on when the market has plummeted or peaked. Another advantage of this strategy is that when markets fall, only part of your investment is exposed to this decrease and not the full amount that will be invested at the end of the period. In conjunction with this, during a downturn, the same amount of money will buy more shares or units for that month. To read more about dollar-cost averaging, click here.

In conjunction with this, regularly investing is likely to be a more suitable approach for those investors who may not have larger sums of money to invest or may not have a cash reserve to rely on in the event of a shortfall. This approach not only gives you market exposure and thus enables you to work towards achieving your goals, but also ensures you have adequate liquid cash available for any unexpected expenses or emergencies that may arise.

How do I set up a regular investment plan?

Now that you have a clear idea of your goals and their relevant time frames, as well as the many benefits of regularly investing, you can now implement a structured plan to put it all into practice. Planning is the key to successful investing and hence creating a plan will allow you to find how you can achieve the goals you have set for yourself.

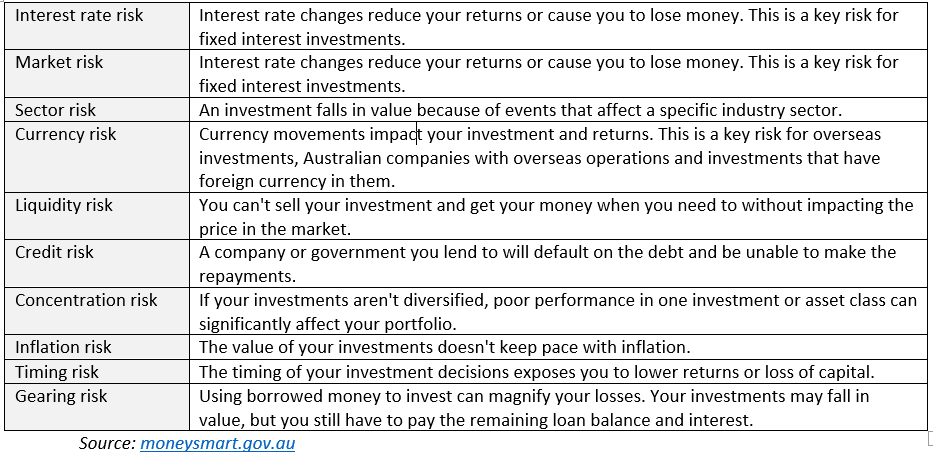

It is also important to understand investment risk as a part of your investment plan. This risk refers to the likelihood you will lose some or all of the money you have invested. All assets carry investment risk, and it is up to the individual investor how much they wish to bear. Below is a table outlining the risks that you will need to consider:

Once you understand the varying risks associated with the stock market, this will help to determine the asset classes you should invest in. What you choose to invest in will be contingent on both the risks associated with that specific investment as well as the timeframe of when you will need the money to be liquidated.

If you are saving for retirement in 40 years’ time, you may wish to invest your money in a high-growth investment choice such as direct shares, ETFs or a high growth managed fund. However, if you require the funds to achieve a short-term objective, you may wish to choose a more defensive asset class such as government bonds or domestic or international fixed interest. To read more about the difference between ETFs and managed funds, click here.

You are almost ready to implement your investment plan as you have all the main ingredients required for a successful investment journey. The final consideration is how much you have to invest. This will differ from person to person depending upon their earnings, financial position as well as their goals. What is important to note is that you don’t need to be rich to invest but to be rich, you need to invest and hence, it is important to start with what you have.

If you were to invest $500 every month from 21 until retirement with an average rate of return of 7.5% you can create an investment portfolio of $1.2 million – however, if this money was left in cash, it would be worth only $240,000. Thus reinforcing, it is not about timing the market, but time in the market.

Now that you have all the key ingredients including:

- Your short-, medium- and long-term goals

- The benefits of regularly investing

- Understanding of the investment risks

- The risk associated with different asset classes

- The amount you wish to invest

All that is left for you to do is set up a regular deposit from a bank or savings account into an investment platform that mirrors the asset classes you wish to invest in. Prior to making any decisions, it is important to read the PDS of any investment product as well as understand the costs, risks and benefits associated with each investment choice.

If you would like assistance with your current investment strategy or have a more complex portfolio, with no time to manage it, please click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser to see if we can assist you.