Life insurance, life cover or death cover, all refer to the lump sum paid when the person insured by the cover dies or becomes terminally ill. This money goes to the people who the person nominates as their beneficiaries. If no beneficiary is nominated, the super trustee or estate determines where the money ends up.

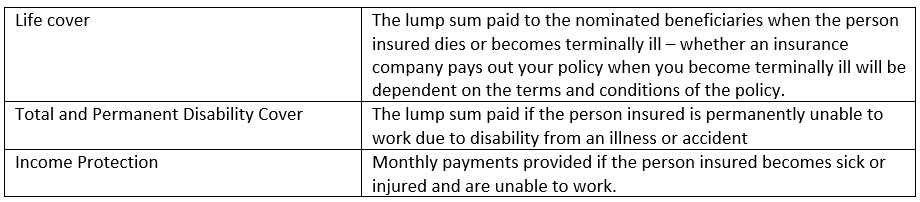

Life insurance is often the umbrella term used to refer to death cover as well as Total Permanent Disablement (TPD) and income protection (IP). Another type of insurance you may be familiar with is trauma insurance, however, this is different to life as it is the lump sum amount paid if the person insured suffers a critical illness or serious injury. The purpose of this level of cover is to assist and support your family to pay for medical or rehabilitation costs. The table below outlines the differences between these types of cover:

How does life insurance work?

Life insurance operates in a similar way to other insurances. The person seeking to be insured purchases a policy suitable to their needs and enters into an agreement with the insurer to pay a certain amount of the cover called a premium. This is usually paid on a monthly basis and increases with age. Under this agreement, the insurer agrees to pay the insured amount to your or the nominated beneficiaries if a certain event occurs including death or becoming terminally ill.

PDS and the fine print

The golden rule of life insurance is to ensure that you have read the fine print. Upon signing an insurance policy there will be specific terms and conditions which stipulate what is and isn’t covered by the policy. It is critical that the insurer is aware of all the relevant information concerning your circumstances. These may include the following:

- Your personal medical history

- Family medical history

- Occupation

- Income

- Hobbies

It is also essential that the person seeking to be insured closely reads and understands the insurer’s product disclosure statement or PDS. A PDS includes important information such as waiting periods, what is covered and any other exclusions. It is vital that the insured person is aware of these terms so that in the event the policy is paid out, those who receive the benefit of it know what to expect.

How much life insurance do I need?

A recent study found that the average level of life insurance Australians have is around half the amount they need to be financially secure, and therefore this suggests that many individuals are currently underinsured.

The types and level of cover each person requires will be contingent on their individual circumstances. The following criteria should be taken into consideration when determining the types and level of insurance required:

When you are likely to need cover:

- You have a partner, child or financially dependent loved ones

- A mortgage or other major debts such as a car loan

- Regular financial obligations such as school fees or rent

When you may need less cover:

- A significant and reliable safety net such as savings or investments

- Other people earning an income within your household who could continue working and support you if you were no longer able to

It has been suggested that a good rule of thumb estimates that 30-year-old parents with children require:

- Death cover equal to eight times the annual household income

- TPD cover equal to four times the annual household income

- Income protection cover equal to 75% of the monthly household income

To calculate the level of insurance you need based on your individual circumstances, click here.

How do I get life insurance?

There are three main ways to buy a policy:

- A group policy through your superannuation fund or employer

- A retail policy through your financial adviser

- Buying directly from an insurance company

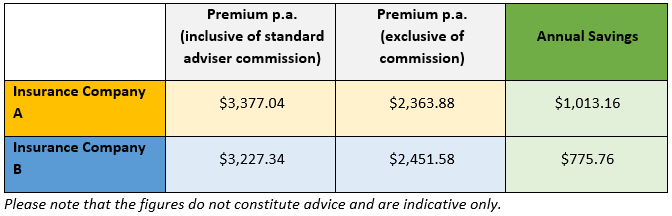

Insurance is not a one size fits all product and therefore it is a good idea to seek financial advice prior to buying a policy to ensure that it is the most cost-effective policy with the right level of cover for your circumstances. However, many financial advisers receive a commission from the premiums you pay for the policies they recommend. Below is a comparison of the cost of insurance premiums with and without commissions.

The figures below assume the client A is a 33-year-old male (non-smoker), earning approximately $220,000 p.a. and requires $1,000,000 cover of life, total permanent disability, and $13,750 per month of income protection. If this client were to hold a policy from insurance company A for a period of 10 years, they would end up paying an additional $10,131 in premiums.

Client A:

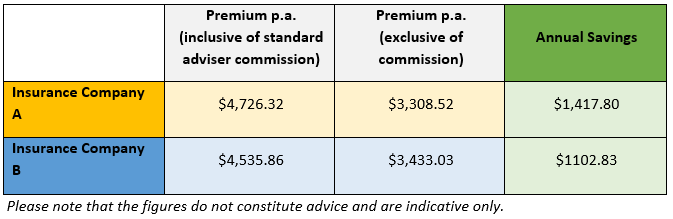

Similarly, below is the cost of insurance premiums assuming the client is a 40-year-old female (non-smoker), earning approximately $200,000 p.a. and requires $1,500,000 cover of life, total permanent disability and $12,500 per month of income protection.

Client B:

If client B were to hold a policy with insurance company A for a period of 10 years, they would end up paying an additional $14,178 in premiums. Therefore, these comparisons show that there are substantial savings when advisers do not take commissions on the insurance policies they recommend and hence this should be a primary consideration when engaging with an adviser. Therefore, although no implementation fee may be more appealing at the outset, this is likely to be an insignificant amount in comparison to the additional fees and premiums you will pay due to these commissions.

EPG Wealth is one of the only financial advice firms in Sydney that does not take any commissions on insurance. If you would like to receive an analysis of your current personal insurances to determine your potential savings, click here.