Owning a property, whether it be your principal place of residence, or an investment property has been packaged and sold to Australians as the best form of investment since the middle of the last century. The age-old question of whether to invest in shares or property still has strong proponents on either side of the debate. This article will discuss the advantages and disadvantages of each to help you make an informed decision.

Why do people prefer property?

Many Australians have been sold the idea that the value of a property will always increase and therefore is the best way to invest your money. Although investing in property may seem like an attractive option it is important to weigh up all the pros and cons. Despite this widely held belief, research suggests that prices in rental markets have recently decreased to adjust to the reduction in demand as a result of the pandemic, which may suggest that investing in property may not always be the most secure investment.

Growth:

The first common characteristic between both investments is that they have the potential to grow over time and generate a return. The financial year of 2020/2021 saw the Australian share market finish the fiscal year with its best performance since inception, with the market gaining 23.9% over 12 months and recovering from the losses incurred as a result of the COVID 19 pandemic.

The returns generated from each investor’s portfolio will be contingent upon the level of risk they are exposed to. High growth investments such as shares and ETFs incur greater risk but at the same time, the potential for a greater return. In saying this, it can also mean a greater loss in the event of a market downturn. Defensive investments such as government bonds and fixed interest are less volatile assets but hence generate lower returns. The level of risk an investor is willing to take on will be dependent on their short- and long-term goals, their current wealth as well as their investment time horizon.

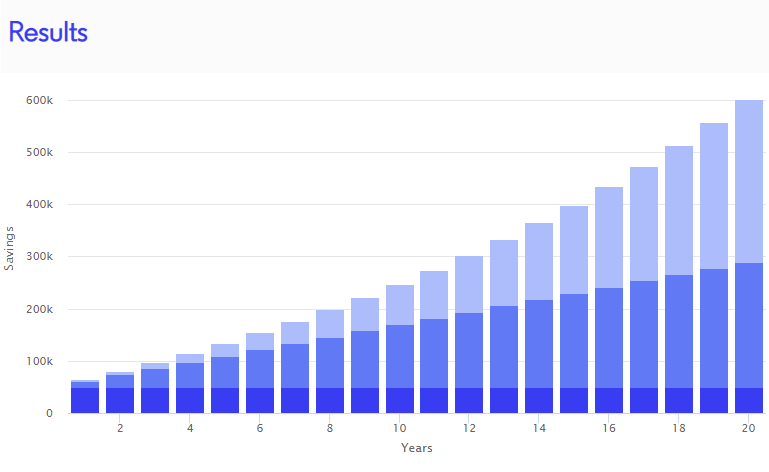

Investing in shares also grows your wealth through compound interest which the great Albert Einstein once said was the ‘eighth wonder of the world.’ Compound interest refers to the returns generated from well-performing funds or shares being reinvested and compounding an investor’s returns overall. Thus, allowing your money to grow at a faster rate than constantly buying and selling different investments in an attempt to enter and leave the market at the right time.

If you were to invest $50,000 today and contribute $1,000 every month, over a 20-year period at an annual rate of return of 6% p.a., by 2041 you would have $601,784, with more than half of this amount ($311,784) being made up of compound interest.

When making your decision, it is a good idea to conduct some comparisons based on your current level of wealth and what you are planning to invest in shares or the property market. Similar to the performance of the ASX, the Sydney house market has also rebounded well from the drops in March 2020 with values increasing by 9.3% last financial year. Regional NSW also performed well with an increase of approximately 9.0%.

There is a common myth that properties will double in value every 7 to 10 years. However, research shows that the growth rate for a well-located property in Sydney is approximately 7% p.a. So although some properties may increase two fold, this is not the case for every property and therefore, it is important that investors make a calculated and informed decision based on all the risks and benefits.

Income:

Investing in both the stock market and property also provides investors with a source of income. 2021 Bloomberg Data suggests that the S&P/ASX has a yield of 2.7% p.a. plus franking credits, whereas the yield for houses in Sydney and Melbourne has reduced in the last 12 months to around 2-7-2.9%. To understand and compare these yields it is important to consider the respective costs associated with each investment.

Maintenance and transaction costs

There is a range of costs associated with investing in property including upkeep, renovation and repair costs to ensure the property is maintained over time. Other costs associated with property on top of the purchase price includes pest and building inspections, legal and conveyancing fees as well as stamp duty. It is estimated that a purchase of a $1,000,000 property in NSW, not including ongoing costs such as mortgage repayments can be up to $57,000. To read more about these costs, click here.

Investing in the share market can incur next to no yearly maintenance costs contingent on the buys and sells of each investor. If you are using an adviser or broker, there will be fees charged for the service they provide which may be a flat fee or a percentage based on the value of your portfolio. To read more about the costs of financial advice, click here.

If you manage your portfolio independently, ETFs are a viable option as they incur management fees that are inbuilt into the price of those funds. You may also be charged transactions costs such as brokerage when you buy and sell shares, however, choosing lower-cost funds such as ETFs and steering clear of expensive managed funds can help keep these costs to a minimum. When compared to the costs of purchasing and managing a property, investing in the stock market has the potential to be a lot more cost-effective for savvy investors.

Flexibility

Investing in property, depending on where and what you choose to buy is a process that may require you to start saving 10 years in advance. Saving for the deposit required to secure a mortgage is a timely process and may also require you to incur additional expenses such as mortgage insurance as well as mortgage repayments. Despite interest rates being at record lows, investing in property requires investors to have liquid cash every month to support the repayment of the loan.

However, if you would like to invest in the stock market – you can start today and can start with $500 or less. If you were to invest $500 every month from 21 until retirement with an average rate of return of 7.5% you can create an investment portfolio of $1.2 million – if this money was left in cash, it would be worth only $240,000. So, while some investors may wish to leave this money in cash to put towards a deposit, this money can be used to start growing your portfolio today.

Diversification and liquidity

Another advantage of investing in the stock market is that it allows for diversification. This refers to investing in a wide variety of asset classes such as domestic and foreign companies over a range of sectors in both defensive and growth assets. Doing this can also reduce the impact of short-term market volatility as different investments react in different ways. Investing in ETFs provides investors with the opportunity to buy a share in a large range of companies instead of just one or two directly on the ASX.

Another important advantage of investing in shares is the benefit of the cash being liquid. Although you will pay some transaction costs and potentially capital gains tax from selling down your investments, this option is available at any time if you require cash in an emergency – however, this is not the case with investing in property.

When investors are considering investing in property it is important to remember that a lack of diversification and liquidity is one of the downfalls of this form of investment. Home buyers need to have liquid cash flow in order to secure a mortgage as well as support its repayments. Purchasing a property also means that investors are exposed to one market only; the property market and thus it is difficult to protect yourself against volatility and market downturn.

Before making any decisions, it is important to consider all the benefits, risks and costs associated with any investment. If you are seeking guidance and wish to discuss the best options available to you, click here to organise a complimentary 20-minute phone call with an EPG Wealth adviser